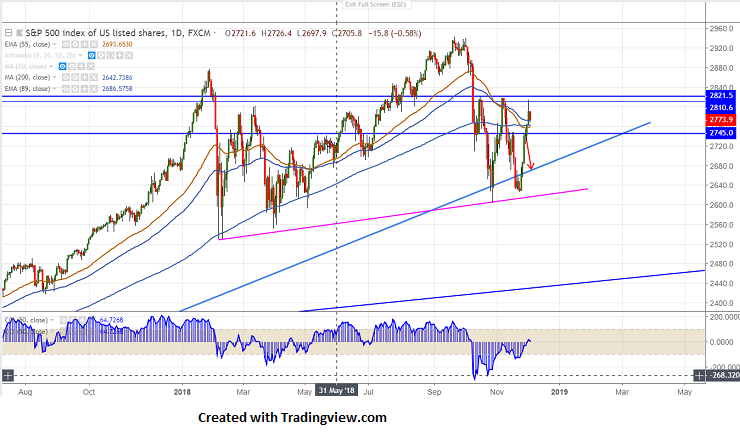

Major resistance- 2820

S&P500 has once again declined after showing a jump above 2800.The index has formed almost a triple top (2821,2818 and 2813) and started to decline. US markets jumped sharply yesterday continuously for second day after US-China trade truce.Trump and Xi trade truce rally lasted only for 24 hours.It hits low of 2767 and is currently trading around 2.

The near term resistance is around 2820 and any break above targets 2845/2870 (78.6% fib)/2900. The index should break 2940 for further bullishness.

On the lower side, near term support is around 2761 (200- day MA) and any break below targets 2740/2718 (20- day MA).

It is good to sell on rallies around 2800 with SL around 2821 for the TP of 2760/2740.