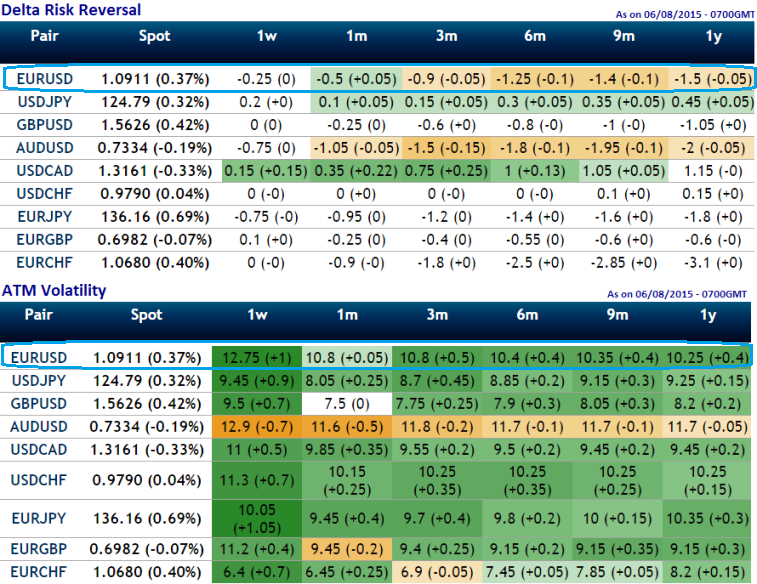

As we can make out from the volatilities of EURUSD ATM contracts, it is comparatively higher side even at 1W tenor. As a result 1M ATM contracts have peaked 11.0 yesterday from 10.3 pre-lockhart Tuesday and now 10.9.

While delta risk reversal of this pair divulges that the hedging downside risks has been relatively expensive as there you can observe negative delta risk reversal persists over next one year.

So we think the premiums on put options would be highly volatile regardless of swings, on speculating grounds one can get benefitted from such situations by buying one touch binary vega puts in order to extract leverage on extended profits.

More importantly, it's a bit puzzling as yesterday's US trade balance has disappointed massively to print its trade deficit at 43.8 billion versus projections at 42.8 billion and from previous flash at 41.9 billion, this increase in deficit may slightly be perceived as negative for dollar in short run otherwise the currency looks in god shape. Overnight volume 22.25 or 102 pips straddle pre NFP. 1wk is 12.55 or 150 pips premium.

FxWirePro: Trend projection of EUR/USD through delta risk reversal and ATM volatility

Thursday, August 6, 2015 12:15 PM UTC

Editor's Picks

- Market Data

Most Popular

8

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand