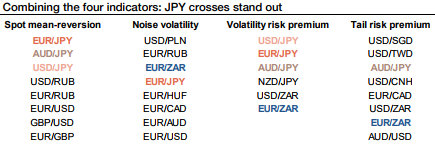

Based on the combinations of four indicators, the suitable currencies are identified for the strongest patterns favouring a DNT trades.

The results are demonstrated in above table, where JPY crosses really stand out. EURJPY, AUDJPY, and EURZAR are identified by three or the four indicators.

EURUSD, USDJPY, EURCAD, EURRUB, and EURZAR are identified by two indicators. These pairs are likely to have interesting potential for DNT trades.

Spot mean reversion: Over the past six months, the ADF tests indicate that JPY crosses experienced strong mean reversion, as did RUB crosses. In G10, EURUSD, GBPUSD, and EURGBP are not very far from them. The least stationary pairs are TRY crosses.

Noise volatility: Realized volatility analysis shows that USDPLN experienced the most ‘noise’ volatility (as opposed to a volatility generating trends). This is also the case for a set of EUR crosses, against RUB, ZAR, JPY, HUF, CAD, AUD, and USD.

Volatility risk premium: Globally, EM volatility is more expensive than G10. In G10, JPY implied volatilities turn out to be by far the most expensive, in particular, the 6m and 1y expiries. In EM space, ZAR volatilities are very expensive. EURUSD, GBP and CAD volatilities are the cheapest.

Tail risk premium: Except the KRW, USD/Asia EM currencies have a low tail premium. This is also the case for JPY, ZAR or NZD crosses. USDKRW unsurprisingly has the biggest tail premium, reflecting geopolitical concerns. GBPUSD and USDCHF come almost just after, with the market still pricing Brexit tail risks for the former. EURMXN and EURUSD present some premium too. Courtesy: SG

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential