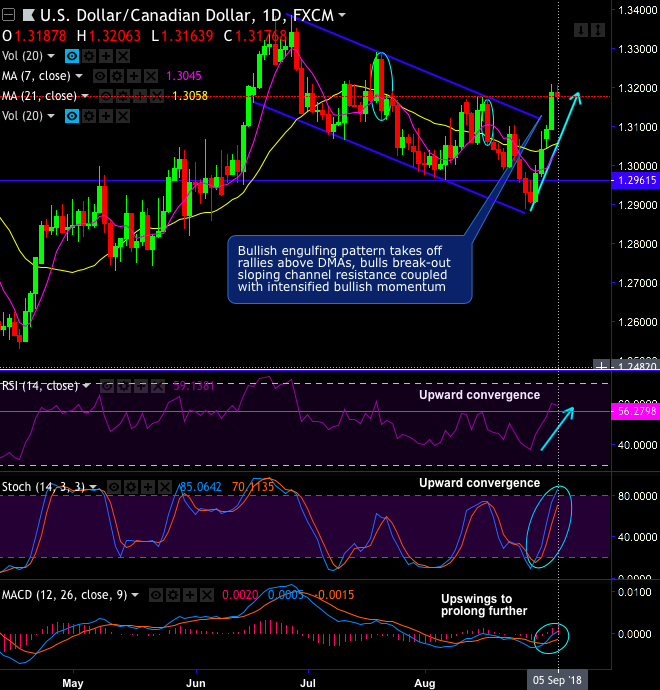

- Technically, bullish engulfing pattern has taken off USDCAD rallies above DMAs, bulls managed to break-out sloping channel resistance coupled with intensified bullish momentum and one can expect more upswings upon the convincing break-out above these levels. For now, the bulls are activated at stiff channel resistance of 1.3125 levels. And the momentum is also confirmed as both RSI & stochastic curves show upward convergence, while trend indicator (MACD) signal more rallies on cards upon bullish MACD crossover (refer daily chart).

- While the major trend spikes through rising channel pattern which is bullish in nature, shooting star pops-up at channel resistance and hammer pattern at channel supports. For now, rallies spike above 7EMAs on hammer formation at 1.3041 levels, strength in uptrend is signaled by momentum oscillator (RSI), stochastic curves have been little indecisive but bullish bias. On the lower side, even if you see abrupt slumps, the near-term support is seen at around 1.3113 levels.

- Well, we have revised our CAD forecasts weaker in light of a more hostile trade policy environment, which may last through US mid-terms, and some supply- bottleneck renewed downside risk in crude prices. We expect USDCAD now to remain at 1.3375 by Q3, the high end of the range seen recently, before moving back towards the middle of the range around the turn of the year (end-17 revised to 1.27 from 1.24 prior) on account of escalating US and other economies trade war. But for now, scenarios seem to be turning around the table.

- WTI Crude oil prices has shown a huge recovery from the low of $64.45 to the recent highs upto $71.37 levels, but slid back again towards the current $68.96 levels. While OPEC has announced that output is set to increase by 1MMbbls/d.

- Trade tips: Contemplating prevailing bullish sentiments of this pair, at spot reference: 1.3171 levels, it is wise to trade double touch options using strikes of 1.3207 levels and attain exponential yields.

- As we could foresee upside risks in the weeks to come, on hedging grounds, we advocate initiating longs in USDCAD futures contracts with a view to arresting further upside risks.

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -65 levels (which is bearish), while hourly USD spot index was at 52 (bullish) while articulating at (11:14 GMT). For more details on the index, please refer below weblink: