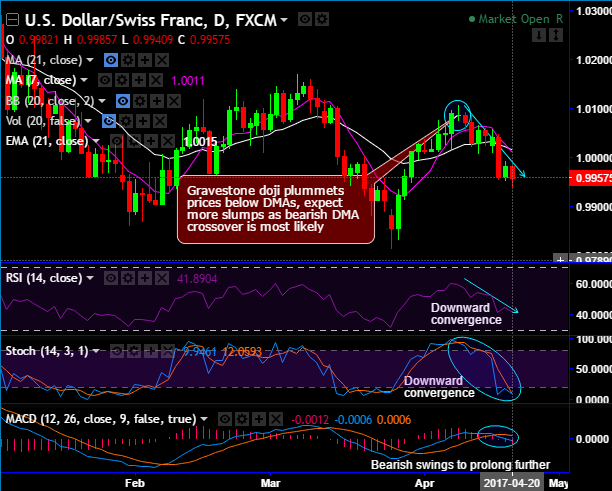

On the daily chart, the gravestone doji occurred at 1.0086 levels.

Ever since this bearish pattern occurred, bears have managed to plummet the prices below DMAs.

It is attempting to break strong support at 0.9958 levels. Expect more slumps as bearish DMA crossover is most likely and the current prices are well below DMAs.

This bearish sentiment is backed by the momentum signaled by leading oscillators.

Both RSI and stochastic curves are converging downwards to the prices slumps.

On a broader perspective, a spinning top has occurred on monthly terms to plummet prices to bring back major trend in range, expect more slumps on the slide below 7EMA.

You could also observe the shrinking buying momentum as the leading indicators on this timeframe, while the same leading oscillators are evidencing bearish convergence to the considerable price declines on this timeframe.

While for short term bearish trend, MACD's bearish crossover is substantiating the downtrend is likely to prolong further (refer daily plotting).

Thereby, USDCHF major trend continues to drift into sideways but bearish bias – Use mid-month futures to hedge.

Hence, at spot ref: 0.9959 we advocate arresting these bearish risks by initiating shorts in futures contracts of mid-month expiries by keeping the strict stop loss at around 1.0197 levels.