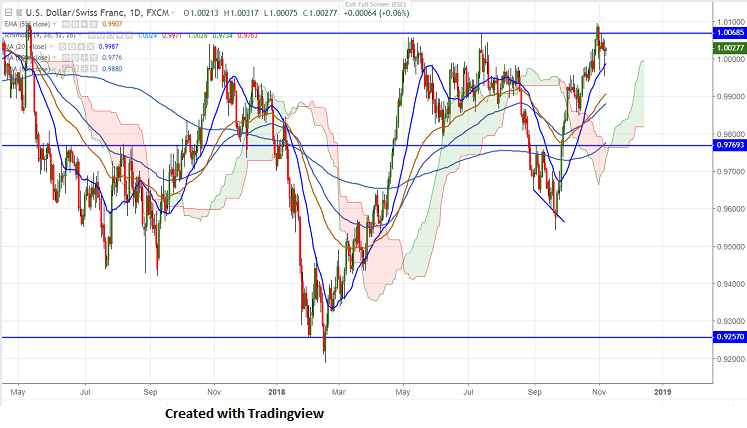

Ichimoku analysis (Daily chart)

Tenken-Sen - 1.0024

Kijun-Sen - 0.9964

USDCHF has recovered more than 80 pips from ow of 0.99525 made yesterday. The pair formed temporary top around 1.00949 on Oct 31st 2018 and declined almost 140 pips. It hits intraday high of 1.00317 and is trading around 1.00239.

The near term major support is around 0.99430 (61.8% fib) and any break below targets 0.9900/0.9850. It should break below 0.9850 for further weakness. The minor support is around 1.000.

On the higher side, near term resistance is around 1.00340 and any violation above targets 1.00680/1.0100. The pair trend reversal only above 1.010.

It Is good to sell on rallies around 1.00340 with SL around 1.00680 for the TP of 0.9945/0.9900.