USDCHF has shown a huge recovery of more than 50 pips for the day from low of 1.00480. The main reason for the jump is broad-based dollar buying after hawkish Fed monetary policy and slightly easing geo political issues. The pair hits high of 1.01033 after breaking high 1.00940 made on Oct 31st 2018 and is currently trading around 1.00961.

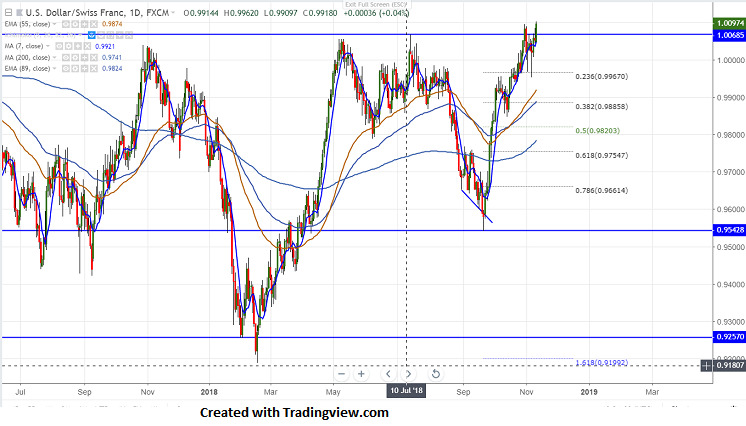

Short term trend is bullish as long as support 1.00370 (7-day MA) holds. The near term support is around 1.00370 and any break below targets 1.000/0.9950. THE minor support is around 1.00690 (23.6% fib).

The pair jump above 1.0100 confirms bullish continuation and a jump till 1.0170/1.0340 is possible.

It is good to buy on dips around 1.0060 with SL around 1.000 for the TP of 1.017/1.0340.