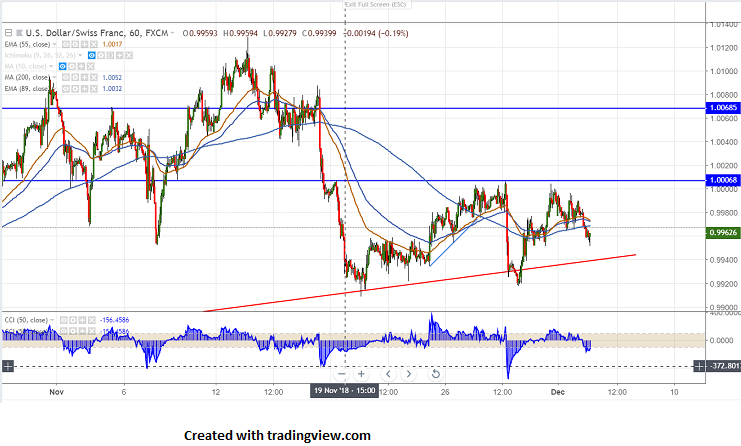

Major resistance - 1.0010

USD/CHF is consolidating between 1.00059 and 0.99088 for past 10 trading days. The pair shown a minor recovery yesterday till 0.99902 after US-China truce but not able hold at higher levels. It has declined till 0.99512 and is currently trading around 0.99599.US ISM manufacturing index rose to 59.3 in Nov from 57.7 in Oct and slightly above forecast of 57.6.

On the lower side, near term support is around 0.9950. Any violation below targets 0.9900. Any break below 0.9900 will take the pair further down till 0.9850/0.9800.

The major resistance is around 1.0010 and any break above targets 1.00680/1.0125. The pair should break above 1.0130 for the further bullishness.

It is good to sell on rallies around 0.9975-80 with SL around 1.0010 for the TP of 0.9900.