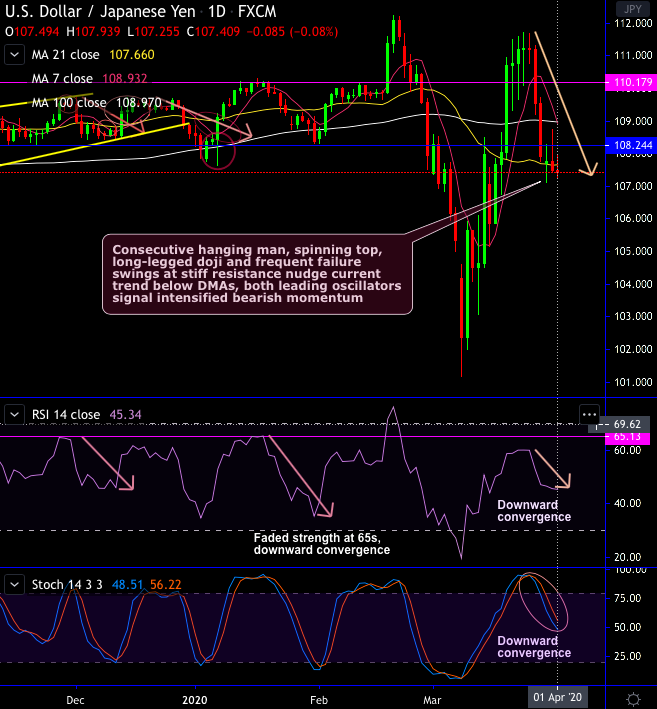

USDJPY minor trend is showing volatile trend (oscillating between 107.939 and 107.122 levels), although minor trend has moved slightly upwards, overbought pressures counter these rallies.

Consecutive hanging man, spinning top, long-legged doji and frequent failure swings at the stiff resistance nudge the current trend below DMAs as both leading oscillators (RSI & Stochastic curves) also signal the intensified weakness.

On a broader perspective, the major trend still remains range-bounded swings upon a bearish engulfing with big real bodies (refer monthly plotting), the major trend is capped by 100-EMAs and 100-DMAs.

With leading oscillators signal overbought momentum, while lagging indicators looking quite indecisive but bearish bias, contemplating both interim downswings and the major downtrend in the long term, prolonged range-bounded major trend remains intact.

Trade tips: At spot reference: 107.478 levels (while articulating), contemplating above technical rationale, it is wise to deploy tunnel spread options strategy using upper strikes at 107.5 and lower strikes at 105.826 levels. The strategy is likely to fetch exponential yields than the spot moves as long as the underlying FX remains between these two strikes.

Alternatively, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds, we now like to uphold the same positions as the underlying spot FX likely to target southwards up to 105 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.