Refer USD/JPY chart on Trading View

- USD/JPY is extending gradual grind lower along 5-DMA which caps upside.

- The pair is trading 0.17% lower on the day, at 110.88 at the time of writing.

- Data released earlier today showed Japan's GDP largely came in better than expected in Q2.

- Seasonally-adjusted GDP for Q2 clocked in at 0.5% beating forecast 0.3%. The annualized GDP came in at 1.9% above forecast at 1.4%, compared to previous decline of 0.6%.

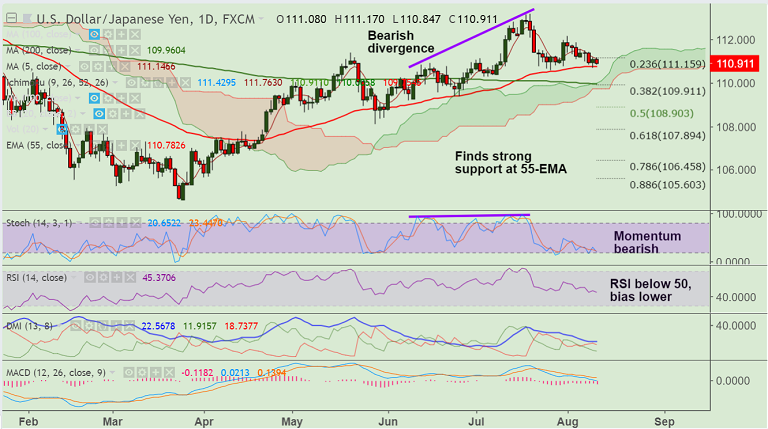

- The major finds strong support at 55-EMA and we see further weakness only on decisive break below.

- Momentum studies are bearish and RSI is below 50 mark. Also we evidence bearish divergence on Stochs which keeps scope for downside.

- Break below 55-EMA could see test of 200-DMA at 109.96. While on the flipside, break above 5-DMA cold see test of 21-EMA.

- Focus now on US CPI due today at 12:30 GMT. An above-forecast print will lift the greenback, while a below-forecast print would lead to a broad-based USD sell-off.

Support levels - 110.78 (55-EMA), 110.22 (110-EMA), 109.96 (200-DMA), 109.36 (June 25, 26 low)

Resistance levels - 111.14 (5-DMA), 111.28 (21-EMA), 112

Recommendation: Good to go short on break below 55-EMA, SL: 111.20, TP: 110.25/ 110/ 109.40

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 41.4286 (Neutral), while Hourly JPY Spot Index was at 103.937 (Bullish) at 0330 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.