- U.S. dollar supported by bullish data overnight, USD/JPY holds gains above 21-EMA.

- U.S. Consumer confidence improved in August, rising 5.5pp to 133.4, above expectations at 126.6. It was the highest reading since Oct 2000.

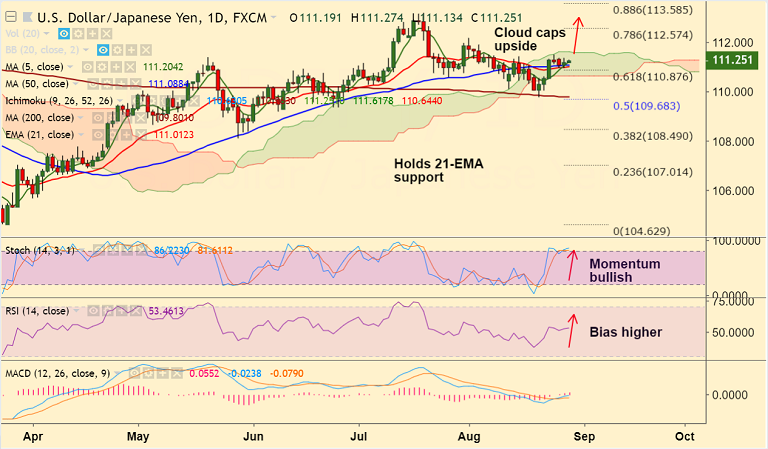

- The major trades with a bullish bias on daily charts. Momentum studies are bullish, RSI is above 50 levels and bias higher.

- Markets will now focus on the second print of U.S. Q2 GDP later today, consensus looks for a modest downward revision to 4.0% from the initial 4.1%.

- Price is consolidating above 61.8% Fib and break above daily cloud will see test of 78.6% Fib at 112.57.

- On the flpside, breach below 110-EMA could see weakness till 200-DMA at 109.80.

Support levels - 111.01 (21-EMA), 110.87 (61.8% Fib), 110.64 (cloud base)

Resistance levels - 111.31 (4H 200-SMA), 111.61 (cloud top), 112, 112.57 (78.6% Fib)

Recommendation: Good to go long on breakout above daily cloud, target 112/ 112.55

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -28.4644 (Neutral), while Hourly JPY Spot Index was at -143.575 (Bearish) at 0145 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.