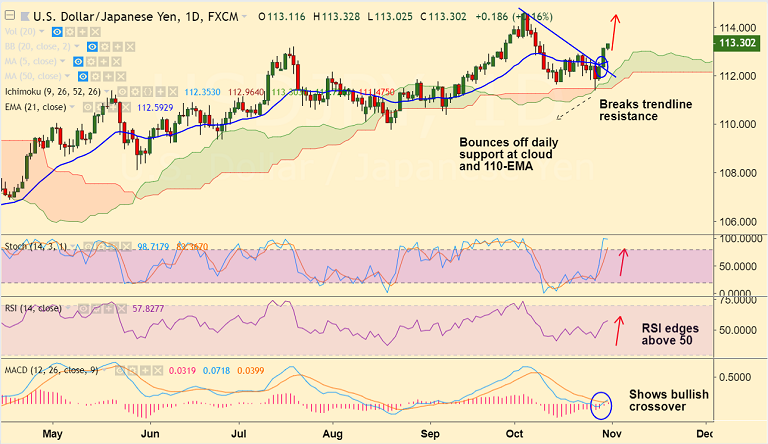

USD/JPY chart on Trading View used for analysis

- BoJ holds policy unchanged, as widely expected. Holds rates at -10bps while maintaining 10yr JGB yield target at 0.00%.

- The central bank also made no changes to a new forward guidance, pledges to keep interest rates extremely low for an extended period.

- The central bank made downward revisions to the Japanese growth and inflation forecasts.

- The pair is consolidating previous sessions gains above 113 handle and is poised to extend its advance up to 113.40 (Sept 8 high).

Support levels - 112.60 (5-DMA), 112.20 (55-EMA), 111.54 (110-EMA)

Resistance levels - 113.40 (Sept 8 high), 114, 114.55 (Oct 4 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-USD-JPY-bounces-off-daily-cloud-positive-momentum-likely-to-continue-good-to-go-long-on-dips-1450650) has hit TP1/2.

Recommendation: Book partial profits at highs. Hold for further upside.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges