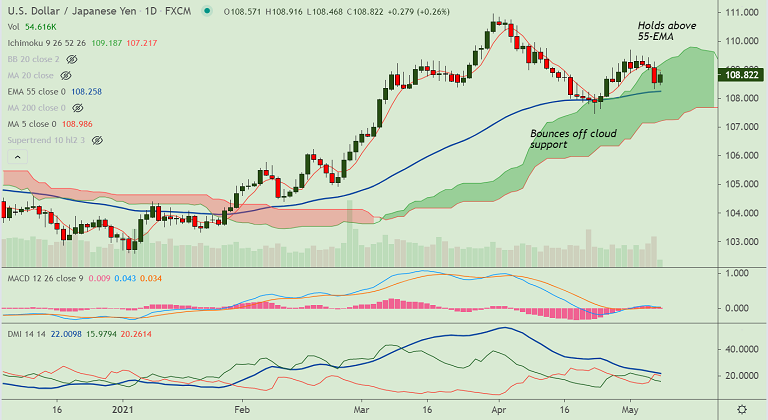

USD/JPY chart - Trading View

Spot Analysis:

USD/JPY was trading 0.28% higher on the day at 108.85 at around 05:15 GMT.

Previous Session's High/ Low: 109.28/ 108.33

Previous Week's High/ Low: 109.69/ 108.33

Fundamental Overview:

Friday’s huge disappointment from US employment details for April reduces the odds of Fed taper getting underway by Q42021.

U.S. non-farm payrolls came unexpectedly lower than market expectations, causing a slump in the US dollar in a knee-jerk reaction.

The US economy added 226k jobs against the market expectation of 1000k, pouring cold water over the rising interest rates hopes.

On the other hand, Japan's extended state of covid related emergency till the end of May is expected to take a toll on the economy and could weigh on the Japanese yen.

Technical Analysis:

- GMMA indicator shows major trend in the pair is neutral

- Recovery finds stiff resistance at 21-EMA, 200-W MA and monthly cloud

- Price action has bounced off daily cloud and is holding above 55-EMA support

Major Support and Resistance Levels:

Support - 108.65 (20-DMA), 108.25 (55-EMA), 108

Resistance - 108.88 (200W MA), 109.07 (200H MA), 109.83 (monthly cloud)

Summary: USD/JPY has paused downside, but recovery attempts lack traction. Series of major resistance are aligned till 109.83. Watch out for break above for upside continuation.