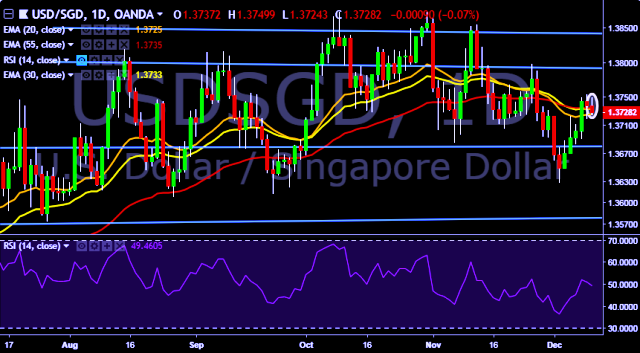

- USD/SGD is currently trading around 1.3727 marks.

- It made intraday high at 1.3749 and low at 1.3724 levels.

- Intraday bias remains slightly bearish for the moment.

- A daily close above 1.3737 will test key resistances at 1.3770, 1.3790, 1.3838, 1.3872, 1.3905, 1.3948 and 1.4050 levels respectively.

- Alternatively, a consistent close below 1.3737 will drag the parity down towards key supports at 1.3690/1.3668/1.3620/1.3570/1.3510 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- Singapore will release retail sales data at 0500 GMT.

We prefer to take short position on USD/SGD only below 1.3720, stop loss at 1.3750 and target of 1.3668.