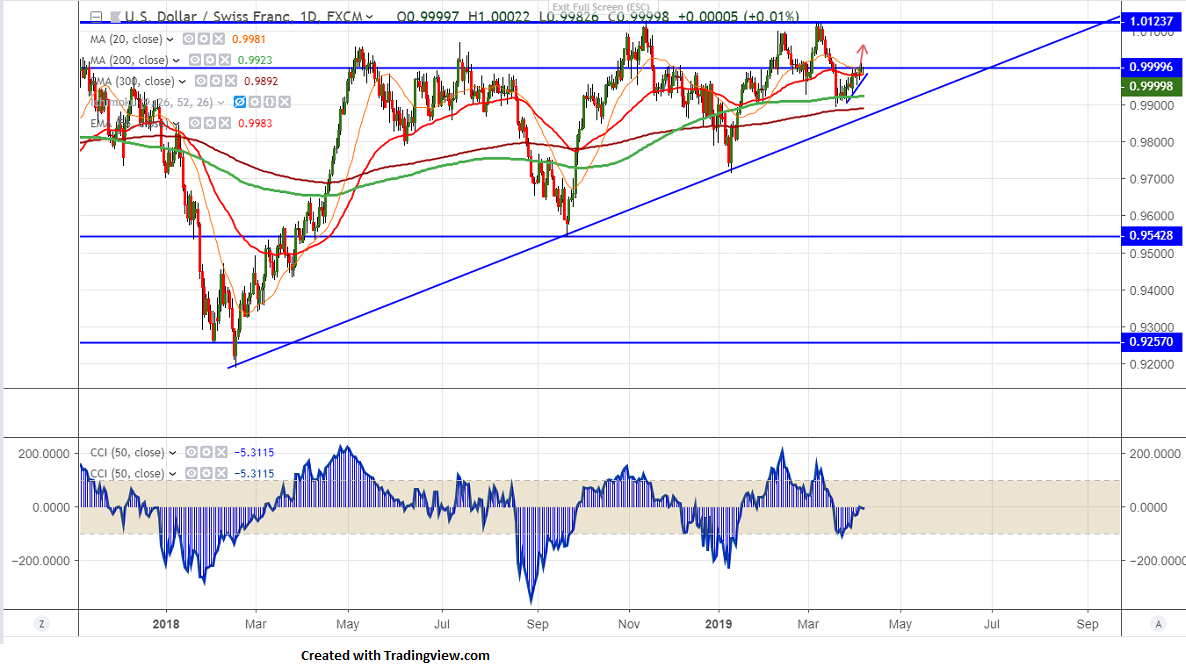

Major resistance- 0.9998 (50- day MA)

USDCHF has declined slightly after shown a minor jump above parity level. It hits high of 1.00122 and is currently trading around 0.99935. US dollar is trading lower amid strong Non farm payroll data. US economy has added 196000 jobs in month of Mar compared to forecast of 177000.US dollar jumped slightly after the data till 97.47 and started to decline from that level. The easing US-China trade tension has decreased the demand for safe haven assets like Gold, yen etc. US 10 bond yield halted its bullishness and lost nearly 2.5% on Friday.

On the higher side,1.0030 is acting as near by resistance and any convincing break above will take the pair till 1.00680/1.010. Any break above 1.0125 confirms major trend reversal.

The near term support is around 0.9950 and any break below targets 0.9900/0.9860.

It is good to buy on dips around 0.9990 with SL around 0.9950 for the TP of 1.010.