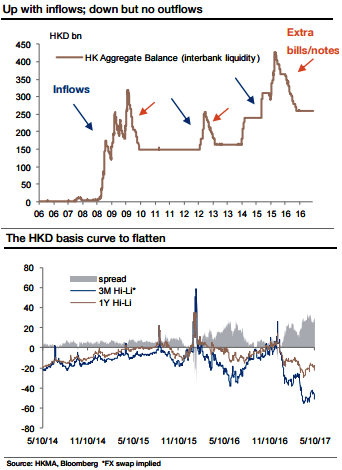

The increases in USD rates have provided further room for HKD rates to outperform. With HKD liquidity likely staying flush in the near term, the burden of adjustment to higher USD rates will fall more on the FX side, preventing HKD-USD rate spreads and forward points from rebounding soon. Investors may continue to prefer selling forward while being long spot.

Until the Convertibility Undertaking (CU) is triggered at the weak side we do not expect spikes in HKD rates. That said, HKD rates should still edge higher as USD rates rise. Moreover, HKMA can tighten HKD liquidity by issuing extra Exchange Fund Bills, and/or conduct market operations even when FX is still within the Convertibility Zone, should they deem this appropriate.

Over the years HIBOR and the Base Rate have moved broadly in tandem, but with short-term deviations. A tweak in the formula for computing the Base Rate can also help influence market rate levels – to guide rates higher in the current context.

Flush HKD liquidity would likely avert HKDUSD rate spreads and the forward points from rebounding in the near-term. Investors may continue to prefer selling forward while potentially buying spot as a protection. There is also demand for USD, from time to time, across Asian markets. When these USD needs are not satisfied by the primary market (bond issuance) or bank loans (in turn funded by deposits), market participants may turn to the money market.

A synthetic USD loan can be attained via CCS or FX swap transactions where market participants buy/sell USDHKD. These transactions exert downward pressure on the local currency CCS and the FX forward points. Low CCS/forward points, in turn, reflect relatively flush HKD liquidity or tight USD liquidity. The downtrend in implied HKD rates in the past few months was entirely caused by lower forward points when USD rates moved up.

Apart from the HKMA engineering HKD rates higher, i.e. via bills issuance, market operations and/or a change in Base Rate formula, the HKDUSD rate spreads may go up when corporate or issuer flows start to dominate, taking advantage of the high spot but deep forward discounts to secure future USD funds via sell/buy USDHKD or forward outright positions.

We would be looking for opportunities to tactically pay HKD rates against USD rates when any sign of the above actions/factors starts to emerge. For now, curve play on the HKD basis curve looks more appealing.

The HKD basis curve is steep across the 3M-1Y segment as the 3M HKD basis is very low. 3M implied HKD rate has been running much ahead of the curve compared with 3M HKD HIBOR.

We expect room for the HKD basis curve to flatten across 3M-1Y. The HKD IRS curve, on the other hand, is biased to steepening with front-end rates better anchored against the backdrop of rising core rates.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?