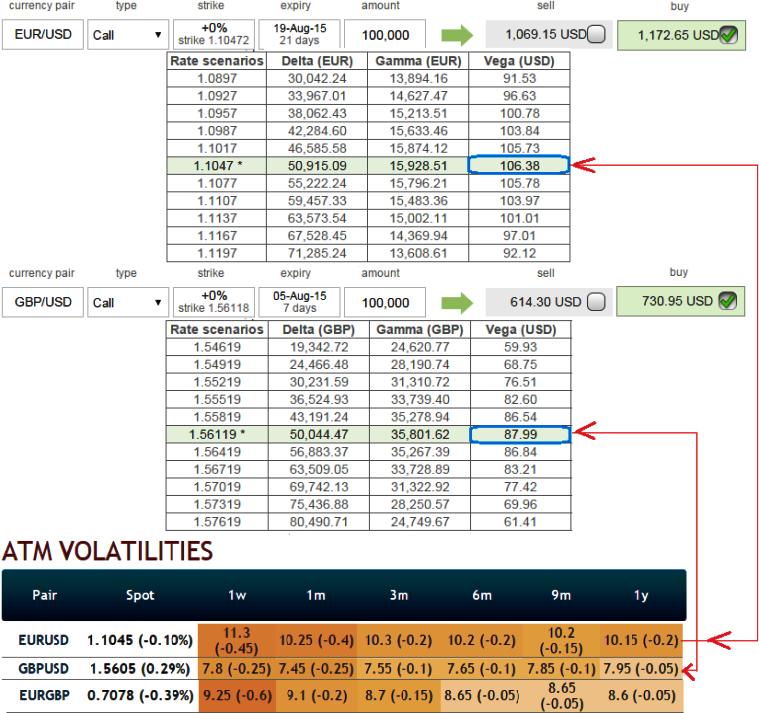

We recommend on speculation basis buying one touch vega calls in order to extract leverage on extended profits. As you can see from the nutshell showing volatilities of ATM contracts (EURUSD - 6 months contracts show 10.2% while GBPUSD at 7.65%), Vega on EURUSD is comparatively on higher side with cable which may have relative delta effects, so by employing these Vega options one can not only multiply the returns by twice, thrice or even pour returns unimaginably but also upbeat the implied volatility. But do remember this call is strictly on speculative grounds.

The prime merits of such one touch option spreads are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch EUR/USD options are constant time and barrier levels. We believe one touch Vega spreads can be the best suitable options to trade HY vols. Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times. For such disparity in volatility between these currency crosses hedging framework would be advocated in our upcoming posts, for traders and hedgers of cable experiencing low volatility, the hedging and trading calls as well would be recommended in our next posts.

FxWirePro: Vega spreads to trade EUR/USD HY vols

Wednesday, July 29, 2015 7:54 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?