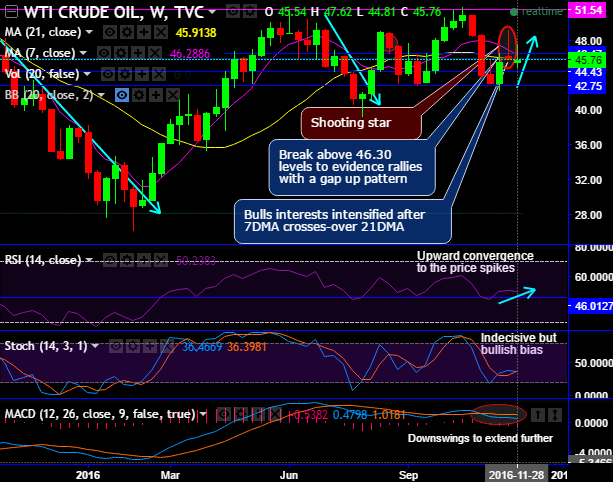

From last two weeks, although the rallies have hit 49.17 levels, the price behavior have remained well between 46.27 and 45.54 (i.e. price range between the last weeks open to this week's open)

The break above 46.30 levels to evidence more rallies with a mild bullish momentum.

Both leading oscillators are indecisive but slightly bullish bias.

But on the contrary, shooting star candle pattern which is bearish in nature has occurred at 45.94 levels last week.

MACD signals the downswings to extend further on the pressure lingering around this energy commodity owing OPEC meeting. Asian energy stocks came under deep distress as the traders watching a meeting between the world's top oil producers in Vienna seen as crucial in supporting prices through output cuts.

As per the speculative standpoints, the OPEC members on Monday have failed to strike a pact on output cuts, with Iraq and Iran - OPEC’s second and third-largest producers.

On the flip side, the optimist laggards still have faith in OPEC would sign an accord to cut output, but skepticism remains over whether it would be adequate to cushion the crude market.

On the broader perspectives, Shooting star occurred even on the monthly term that has evidenced declines below support at 23.6% fibos (dips upto 42.23), thereafter, in November month series we’ve seen the attempts of bouncing back. For now, it seems like the break above 46.43 & 21EMAs to extend rallies.

As the price is stuck in between 46.27 and 45.54 levels as stated above and with seesaw sentiments, at this juncture we think a good chance of double touch barriers to speculate this sentiment.

A trader can use a double touch option with barriers at 46.27 and 45.54 to capitalize on this outlook.

Some traders view this type of exotic option as being like a straddle position since the trader stands to benefit on a calculated price movement up or down in both scenarios.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary