The FX options market is very liquid up to the 2y expiry. This is an appropriate horizon to capture a scenario whereby EURUSD surges to 1.30. In addition, we want to go long vol via calls, as topside vega is going to perform if the skew flips to the positive side. Both our central scenario and the alternative scenario of EURUSD breaking out of its range see a very limited probability that the spot could exit on the downside, prompting us to sell low strikes.

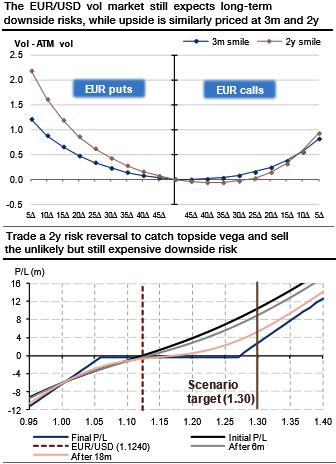

Smile opportunity: Comparing the volatility smile in the near term and long term is insightful. The 3m and 2y smiles price a similar topside volatility, whereas 2y puts still price an extra downside risk (refer above graph). This suggests that 2y calls are cheap since a 25-delta call will be paid at roughly the same implied volatility as a 3m call.

However, selling a 2y put is more rewarding than a shorter one, as the implied volatility of low strikes can be sold at a higher level for the same delta level. Of course, both smiles are still trading in negative territory, making EUR puts still more expensive than calls, regardless of the maturity.

We, therefore, recommend Buying a 2y EURUSD call strike 1.27 financed by a put strike 1.06 (refer above graph). This strategy costs 30pips in current market conditions (1.1240).

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis