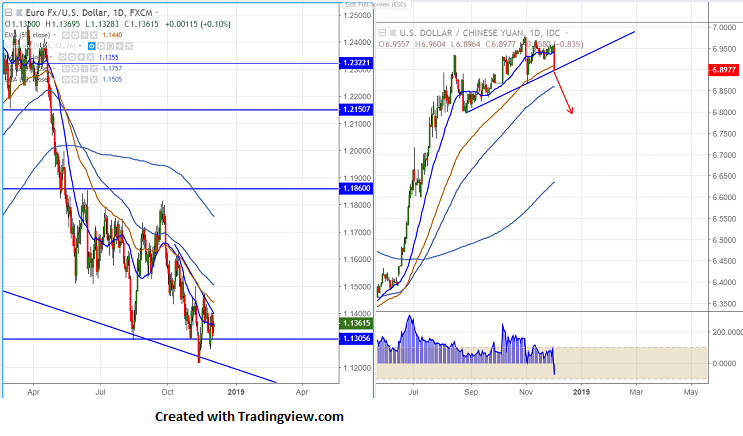

EUR/USD has pared most of its losses made on Friday after 90- day ceasefire on trade tariff. US President Donald Trump has told in meeting to Chinese President Xi that US will not impose 25% tariff on $200 bn worth of Chinese goods for next 90 days. The tariff might get increased only if no agreement is reached after this period. USDCNY has shown good decline of nearly 0.80% and if Chinese yuan strengthens further will push Euro above 1.1402 level.

On the higher side, near term resistance is around 1.14020 level and any violation above targets 1.1435/1.1475/1.1500. The pair should break above 1.1500 for further direction.

The near term support is around 1.1350 and any break below targets 1.1300. Any violation below 1.1300 targets 1.1260/1.1200.

It is good to buy on dips around 1.13500 with SL around 1.1300 for the TP of 1.1475/1.1500.