Hungarian National Bank (MNB) has cut its benchmark rate down to 0.9 percent this year and signalled that the easing cycle is finished for now. The central bank maintained flexible wording around its guidance. While the likelihood of rate cuts already in coming months is low, ECB rate cuts could add pressure.

Growth in Hungary is slowing down in 2016. After a solid 2.9 percent growth in 2015, momentum is rapidly decelerating this year. Recent manufacturing data confirm a loss of momentum, with industrial output back near its 2014 level in absolute terms. The PMI has slipped back to near 51 levels. GDP growth so far this year has increased by less than 1 percent annualised. Full-year 2016 is expected to witness slower than 2 percent GDP growth. Commerzbank revised down their 2016 forecast from 2.2 percent to 1.8 percent, and 2017 forecast from 2.8 percent to 2.5 percent.

As the central bank rules out further monetary easing for now, the forint has been relatively stable. The general EM risk rally has also helped lend support. Hungary's rating upgrade also would be HUF-supportive in the near-term as real money managers will likely be increasing their portfolio exposure to Hungarian assets.

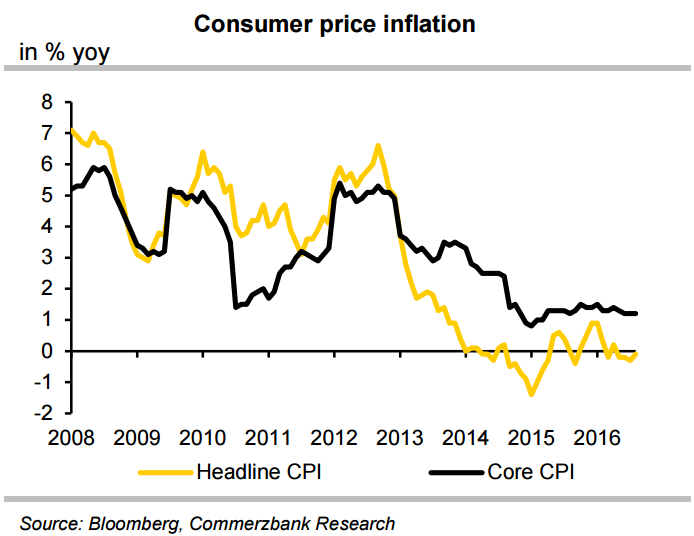

However, Hungary's inflation outlook is far more benign than in recent years and the central bank has lowered its projections this year – 2016 headline inflation from 1.7 percent to 0.5 percent and 2016 core inflation from 2.4 percent to 1.5 percent. MNB forecasts core inflation to accelerate to 2.9 percent in 2017. Base effect from utility price cuts may push headline inflation from negative currently to higher than 1 percent by the end of 2016, but the central bank's forecasts look too ambitious.

"By the end of 2016, we expect continued mild inflation and the noticeable growth downturn to renew the market’s rate cut expectations; this is likely to pressure EURHUF up towards 315.00 by Q1 next year," said Commerzbank in a report.

EUR/HUF is extending higher from new multi-month lows of 305.24 (Sept 22). The pair was 0.05 percent higher on the day, trading at 307.95 at around 12:00 GMT.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady