The Sweden Central Bank (Riksbank) will announce its next policy decision on February 15th. The Riksbank in December followed the ECB in extending its own asset purchase programme. In addition to the SEK 245 billion securities purchased by end-2016, Riksbank said it will buy another SEK 30 billion in bonds by mid-2017. The minutes published in January revealed that three of six board members spoke out against giving an outlook that signalled another rate cut. Governor Stefan Ingves had to use his tie-breaking vote in December to extend the government bond purchases.

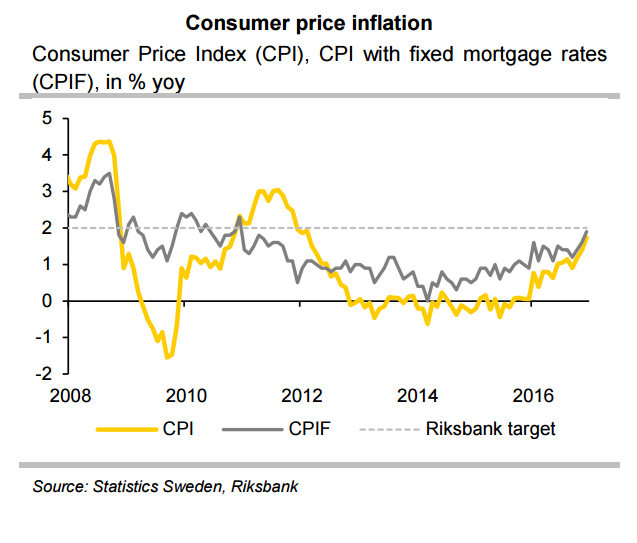

In December 2016, Sweden's annualized CPI inflation stood at 1.7 percent. The annual percentage change in the CPIF was 1.9 percent in December, up from 1.6 percent in November. The Riksbank's target is to maintain inflation at a rate of 2 percent when measured by CPI. With inflation moving close to target, the necessity of a continued expansionary monetary policy decreases.

However, Sweden's central bankers were split over how secure a recent upturn in inflation is, minutes of the Riksbank's December meeting showed last month, with those supporting the decision to expand QE arguing more support for prices was needed. Riksbank will remain cautious since energy prices and the base effect contribute to the rise in inflation. Should the inflation outlook be at risk again, policymakers would be ready to take new measures in 2017.

Sweden's economy has most likely grown again by slightly more than 3 percent in 2016. Economic growth was broad-based, with domestic consumption, investment activity as well as foreign trade all making positive contributions. Manufacturing confidence has risen to its highest in more than two decades, while the purchasing managers index for the services industry has hit a five-year-high.

Recent data may convince some of the more proactive members to accept less biased policy signals. The current easing bias may be reduced as promoted by the three December policy committee dissenters. Deputy Governors Cecilia Skingsley and Henry Ohlsson voted against the decision to expand quantitative easing by 30 billion crowns with Martin Floden wanting to buy 15 billion crowns of bonds.

"Hard data will continue to look good at least for another six months. That’s an environment where the Riksbank can continue to be a bit less proactive, calm down a little bit and perhaps even tolerate that inflation turns out lower than expected for a month or two.” said Martin Enlund, chief currency analyst at Nordea Bank.

The possibility of an end to the Riksbank’s ultra-expansionary monetary policy is generally SEK positive. The Riksbank is, however, unlikely to accept a rapidly appreciating SEK in order not to endanger the recent positive development in inflation rates. Both Danske Bank and Nordea don’t rule out currency interventions should the krona strengthen too much or too quickly.

SEK has rallied almost 5 percent against the euro and 2.2 percent against the dollar since U.S. elections. On the day, USD/SEK was 0.68 pct higher at 8.8085, while EUR/SEK was up 0.24 pct at 9.4582 at around 1020 GMT.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand