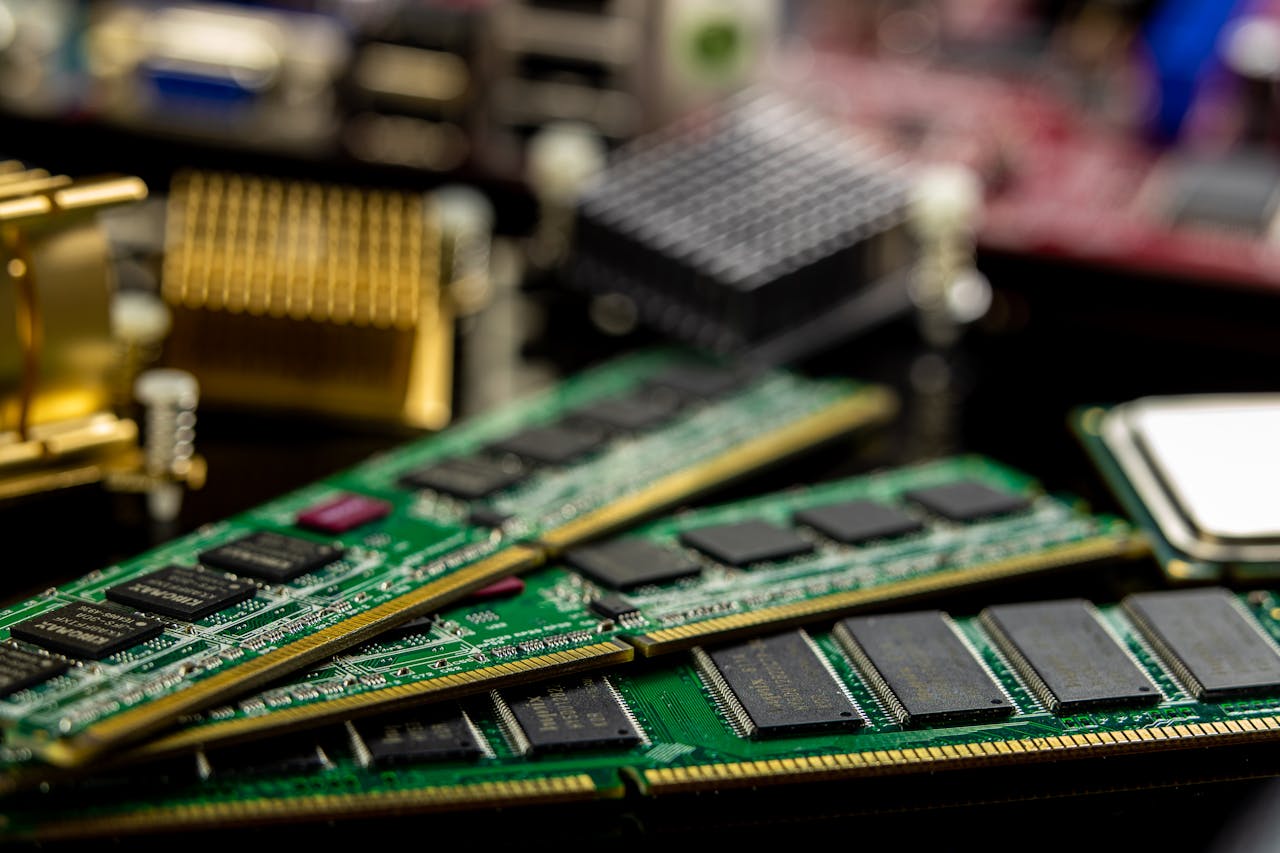

South Korea has expanded its support package for the semiconductor industry to 33 trillion won ($23.25 billion), marking a 27% increase from the 26 trillion won initiative announced in 2023. The move comes as global chip competition intensifies and policy uncertainties grow under the current U.S. administration.

A joint statement from multiple ministries, including the Ministry of Trade, highlighted that financial assistance for the chip sector will now reach 20 trillion won, up from the previous 17 trillion won. The goal is to help domestic chipmakers manage rising costs and enhance competitiveness in a global market increasingly dominated by Chinese rivals.

As the world’s fourth-largest economy, South Korea remains a dominant player in memory chips, led by giants Samsung Electronics and SK Hynix. However, the country is facing challenges in areas like chip design and contract manufacturing. In 2024, semiconductor exports reached $141.9 billion—21% of South Korea’s total exports—with $46.6 billion shipped to China and $10.7 billion to the U.S.

U.S. President Donald Trump recently announced plans to unveil new tariff rates on imported semiconductors, with some flexibility for certain companies. In response, South Korea’s Finance Minister Choi Sang-mok emphasized plans to engage in dialogue with U.S. officials over the Section 232 investigations into semiconductors and biopharmaceutical imports to mitigate negative effects on Korean firms.

Last week, Seoul also introduced emergency support for its auto industry, including tax cuts, subsidies, and financial assistance, aiming to cushion the impact of potential U.S. tariffs. The government reiterated its commitment to negotiating with Washington and diversifying export markets to safeguard its key industries.

This strategic funding boost underscores South Korea's resolve to remain a global leader in semiconductors amid shifting geopolitical and economic landscapes.

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms