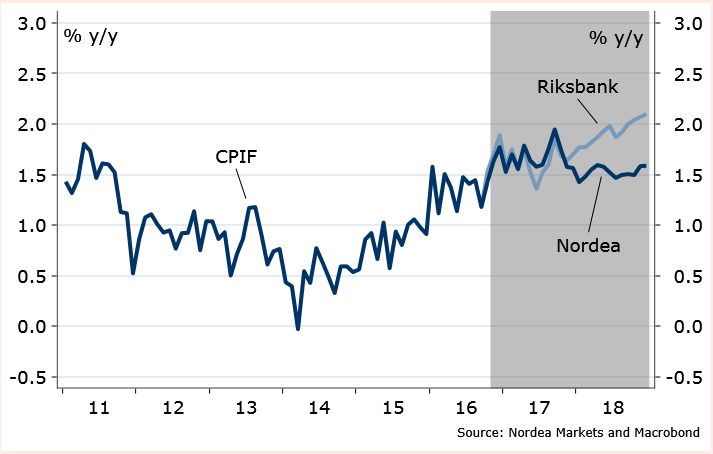

Sweden’s consumer price inflation is likely to have accelerated in November in sequential terms. According to a Nordea Bank research report the CPI index is set to have risen 0.1 percent, whereas the CPIF is likely to have come out at 1.6 percent year-on-year that is 0.1 percentage point below Riksbank’s forecast. Risks are skewed towards the downside.

November inflation is likely to have been driven by travelling prices. The seasonal pattern signifies that prices declined in November. But the fall is expected to have been less than normal as most of the autumn break was in November in 2016. Furthermore, Statistics Sweden changed method in 2016, gauging prices for foreign travelling more evenly over the month. This suggests that the rises in prices during the start of the month might impact the CPI.

“Our call is that prices for foreign travelling shaved off 0.1 percent point in November, compared to -0.3 percent point in the same month last year”, added Nordea Bank.

Meanwhile, food prices continued to increase slightly whereas prices for footwear and clothing are expected to have been largely unchanged. Prices of fuel and electricity moved in opposite directions, nearly balancing each other. Noticeably, both trends have been reversed so far in December, with fuel prices increasing but electricity declining, said Nordea Bank.

FxWirePro's Hourly EUR Spot Index was at -142.929 (Highly bearish), and Hourly USD Spot Index was at 114.508 (Highly bullish) at 1300 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment