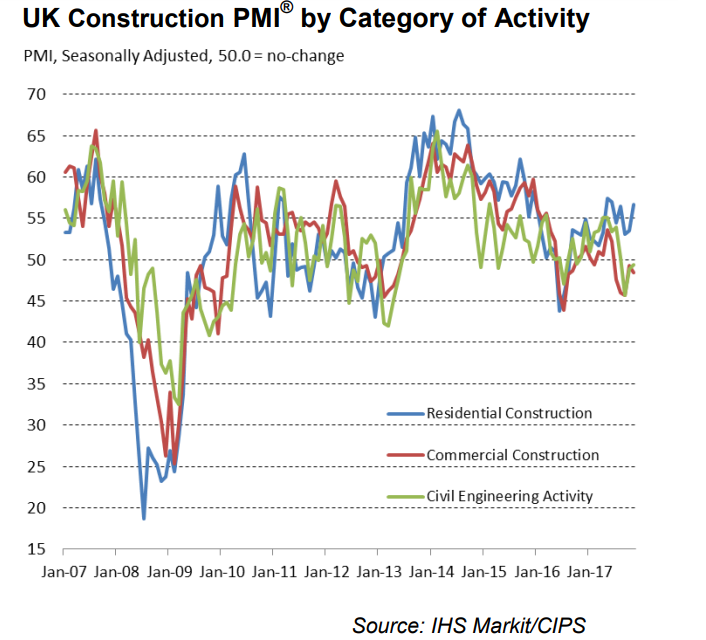

Data released earlier today showed UK IHS Markit construction purchasing managers’ index rose to 53.1 from 50.8 in October, beating economists forecast for a reading of 51.0. The latest PMI surveys, suggest construction has regained some momentum after contracting for two consecutive quarters.

Residential work has been the main driver behind the modest construction rebound in November. The government’s Help-to-Buy equity loan program has supported demand, driving the robust and accelerated upturn in residential work. In contrast, commercial and civil engineering activity continue to decline. Commercial construction continued the trend seen for much of 2017 so far, while civil engineering activity fell for the third successive month.

“UK construction companies experienced a solid yet uneven improvement in business conditions during November,” IHS Markit associate director Tim Moore commented in the report.

The market research firm also pointed out that business optimism picked up from October’s near five-year low, edging up to a three-month high in November. New orders and employment numbers also increased to the greatest extent in five months. However, cost inflation eased to its least in 14 months, with some firms reporting signs that exchange-rate driven price rises had started to lose intensity.

“Overall, the sector showed an incremental improvement, but business optimism was on the rise and up from last month’s five-year low. Perhaps the darkest days are behind the sector with fresh impetus on the horizon for the New Year.” said Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement & Supply.

Cable largely muted around 1.3430 post construction PMI data. Construction comprises account for around 6 percent of UK's economic output. Focus remains on the more important services sector PMI - due on Tuesday. The pair is showing minor weakness on Brexit negotiation uncertainty. UK PM Theresa May is set to meet Claude Jucker EU commission president and will try to reach a deal on Brexit divorce.

The pair was facing strong resistance at 1.3550 and any convincing break above will take the pair to next level till 1.3600/1.3700 level. On the lower side, near term support is around 1.3420 (38.2% fibo) and any break below will drag the pair to next support at 1.3400/1.3375.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary