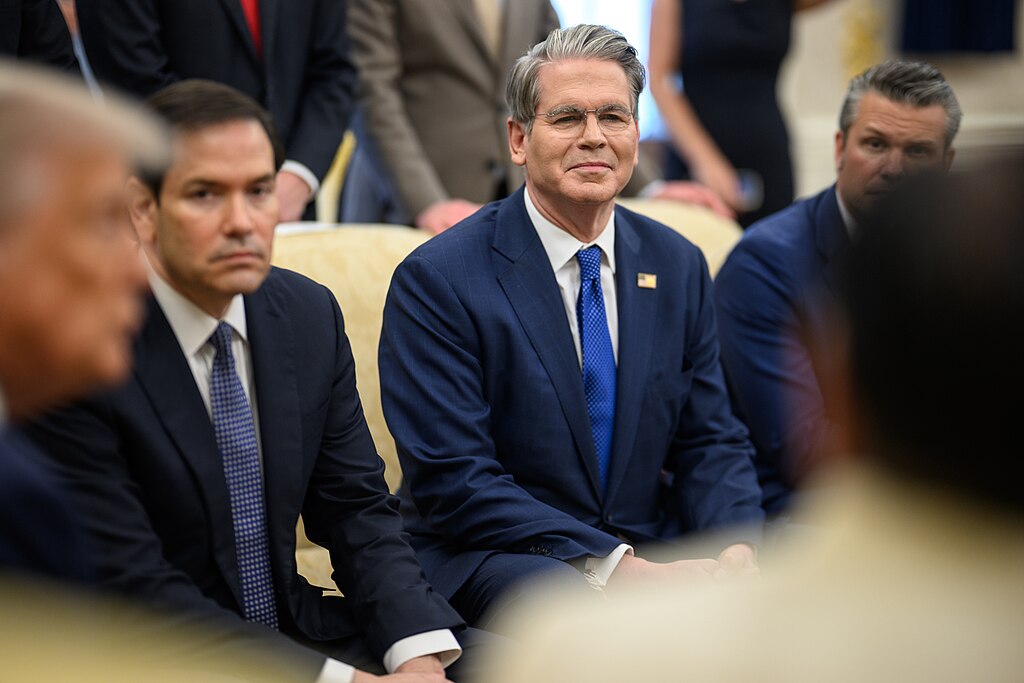

U.S. Treasury Secretary Scott Bessent has emphasized the importance of clear and well-communicated monetary policy during a recent meeting with Japanese Finance Minister Satsuki Katayama, as concerns grow over sharp movements in the Japanese yen. According to a statement released by the U.S. Treasury Department on Wednesday, Bessent highlighted the “inherent undesirability of excess exchange rate volatility,” underscoring the need for sound policy formulation and communication to stabilize currency markets.

The comments come at a time when global financial markets are closely watching Japan for possible currency intervention. Earlier this week, the yen weakened to its lowest level in 18 months, fueling speculation that Japanese authorities could step in to halt its downward trend. The yen showed signs of recovery on Wednesday after Katayama issued another strong verbal warning, stating that officials would take “appropriate action against excessive currency moves without excluding any options.”

Following those remarks, the yen strengthened by 0.43% against the U.S. dollar, trading at 158.46 per dollar. Earlier in the session, it had touched 159.45, its weakest level since July 2024. After meeting Bessent in Washington, Katayama said both sides shared concerns about what she described as the yen’s “one-sided depreciation,” signaling alignment between the two governments on the risks posed by rapid currency swings.

Bessent has consistently argued that Japan’s weak yen is best addressed through tighter monetary policy rather than direct market intervention. He has previously called on the Japanese government, led by Prime Minister Sanae Takaichi, to allow the Bank of Japan (BOJ) to raise interest rates more aggressively. Takaichi is known as a supporter of accommodative monetary policy, which has contributed to prolonged yen weakness.

In December, the BOJ raised its benchmark interest rate to 0.75% from 0.5%, citing progress toward its long-standing 2% inflation target. However, critics argue that the gradual pace of rate hikes has failed to stem yen depreciation. While a weaker yen benefits exporters, it also increases import costs, placing additional pressure on Japanese households and the broader economy.

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients