The United States economy is currently in a solid expansion state and for the first time since the 2008/09 ‘Great Recession,’ the U.S. is close to expanding at its long-term growth rate of 3.25 percent. While the uncertainties surrounding the U.S. mid-term election, President Trump’s Iran policies, and trade tension led to a loss of trillions of dollars in the stock market in October, hard data suggest that the economy remains well into an expansionary phase.

In October, the U.S. benchmark stock index, S&P 500 declined sharply from its high of about 8 percent, pushing the index (SPX500) from 2940 to 2700 area, but at the same time job numbers continued to point to solid expansion.

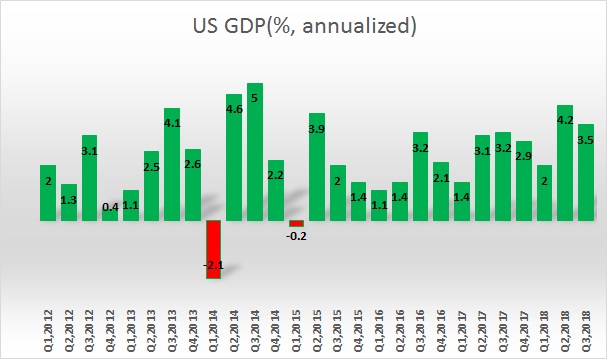

According to data from ADP, the U.S. economy added 227,000 new jobs in October, with 38,000 jobs being created in the goods-producing sectors. The GDP estimate also points to expansion. According to the latest reading, Atlanta Fed’s ‘GDP Now’ model is forecasting a 3 percent growth in the final quarter of the year, revised up from 2.6 percent. The U.S. economy has growth 2 percent in the first quarter of 2018, 4.2 percent in the second, and by 3.5 percent in the third quarter of this year.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence