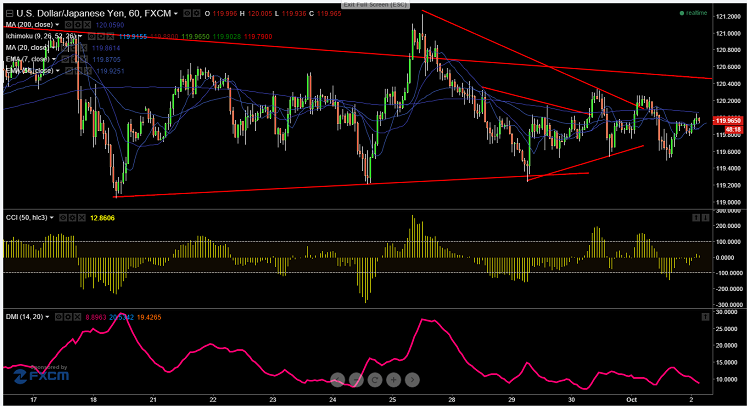

- USD/JPY has made a high of 120.26 yesterday and declined till 119.49 from that level. Sort term trend is till bullish as long as support 119.20 holds.

- Any break below 119.20 will drag the pair further down till 118.80/118.60. The pair's minor support is around 119.50.

- The minor resistance is around 120.10 and any indicative break above will take the pair till 120.75/121.25 in short term.

It is good to buy at dips around 119.70 with SL around 119.20 for the TP of 120.74/121.25