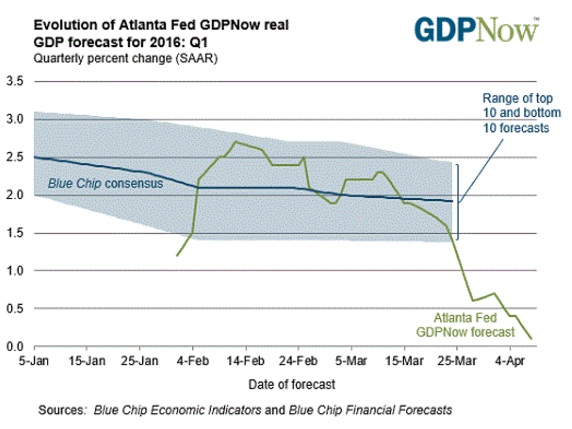

Just 2 months ago, Atlanta FED’s GDP forecast model was predicting 2.5% annualized growth for first quarter in United States. By March second week model growth dropped to 2.3%, but after that it started declining sharply and by April 5th, measure was pointing to just 0.4% growth and last Friday that growth declined to just 0.1%.

Atlanta FED’s model is then just pointing that U.S. Economy is on the brink of a recession. If it comes true, then that complicates thing.

U.S. Federal Reserve is looking to hike rates as early as June and a recession in first quarter may put an end to that ambition. As of now, FED is planning to hike twice this year, while market is predicting just one hike of 25 basis points. If a recession hits in first quarter then market may once again be right in their prediction and FED will have to approach more cautiously.

However only piece of good news is that U.S. economy has traditionally and historically has underperformed in first quarter, which is followed by strong recovery in second and third quarter. So focus will be on next release of ‘GDP Now’, which will be on April 13th.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns