Ethereum reached a multi-month high, following Bitcoin's rise. It hit a peak of $3,446 and is currently trading at around $3,278.

On November 11, 2024, U.S. spot Ethereum exchange-traded funds (ETFs) achieved a milestone with record inflows of approximately $295 million, boosted by a rally in the cryptocurrency market following Donald Trump's election victory. The total inflow of $294.9 million surpassed the previous record of $106.6 million set in July 2024. Leading funds included Fidelity's Spot Ethereum ETF with $115.5 million, BlackRock's iShares Ethereum Trust with $100.5 million, and Grayscale's Ethereum Mini Trust with 63.3 million. As a result of this surge, net flows for the nine U.S.-based spot Ether ETFs turned positive for the first time, reaching 107.2 million on November 12, 2024, with nearly $650 million attracted over the five days leading up to that date, reflecting strong investor interest.

Santiment analysts suggest that as Bitcoin's price rises, profits made by BTC holders may be redirected into Ethereum (ETH). This pattern has been seen in previous bull markets, where gains from Bitcoin investments often flow into altcoins, particularly ETH, which is considered a leading alternative.

Currently, market sentiment for Ethereum is positive, driven by strong network activity and the potential for growth as Bitcoin profits are reinvested. Analysts are optimistic that this trend could help ETH reach new all-time highs, benefiting from the bullish atmosphere surrounding Bitcoin.

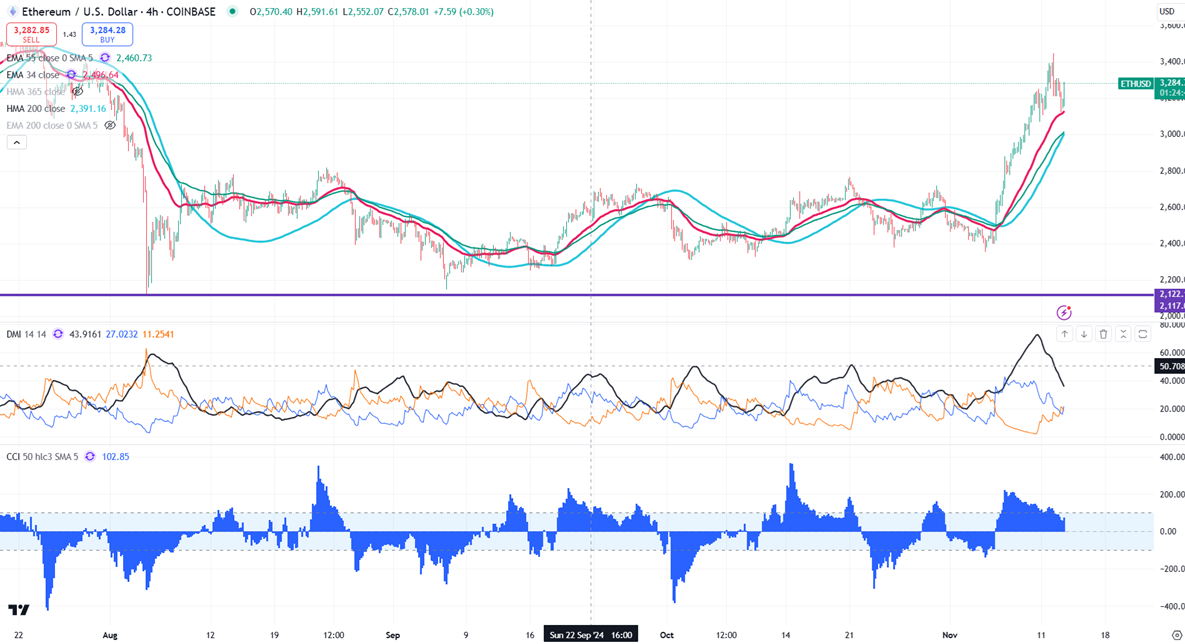

Technical Analysis: Resistance and Support Levels for Ethereum

Bullish momentum may be achievable if Ethereum maintains above 3000. The key near-term resistance is at 3000, with significant upward movement targeting , $3,200, or even $3,400. A robust bullish trend will only materialize above $3,400.

Conversely, immediate support is around $2,770. A fall below this threshold will confirm continued bearish momentum, potentially leading to price drops to $2500/$2300. A breach below $2000 could see Ethereum plummet to $1,800.

Traders may consider buying on dips near $3000, with a stop loss set around $2,770 and a target price of $3450/$4000

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize