WTI has found support at key base around $35 area, however it is likely to face sellers in further rallies.

Key factors at play in Crude market –

- OPEC and non-OPEC members will be meeting on April 17th for follow up discussion on last month’s production freeze decision.

- However, speaking to Bloomberg, Saudi crown prince indicated that there will no production freeze without members like Iran joining in. Iran is unlikely to join as its current production level is much lower than pre-sanction ones. These comments have been instrumental in recent drop in oil price from $42/area.

- Kuwait joined in to control damage by suggesting production freeze can go ahead without Iran.

- Barclays has warned that recent commodities rally isn’t riding on fundamental improvements and it could easily deteriorate if investors rush for exit.

- IEA in its latest report cited initiative and weaker Dollar behind oil rally suggested that price may have bottomed.

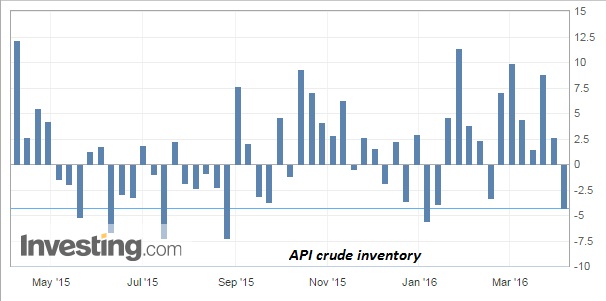

- American Petroleum Institute’s (API) weekly report showed inventory dropped by 4.3 million barrels.

Today’s inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Chart courtesy investing.com

Trade idea –

- Our target on the upside has been reached around $42/barrel and now we are again short on oil.

- Current active call - Sell WTI at current price $39/barrel with stop loss around $42/barrel and target around $34 and $32/barrel. Price has bounced back from $35/barrel area, increase position around $37.8 and $39/barrel area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX