WTI is trying to crawl back some of the loss from yesterday. Further rise towards $40-41 area likely. WTI is currently trading at $36.8/barrel.

Key factors at play in Crude market

- OPEC and non-OPEC members will be meeting on April 17th to follow up on their last month’s meeting. So far almost 15 countries either joined or about to join the initiative of production freeze with controlling supply of 65% of world oil.

- Middle East negotiations back in focus as Russia withdraws troops from Syria.

- IEA in its latest report cited initiative and weaker Dollar behind oil rally suggested that price may have bottomed.

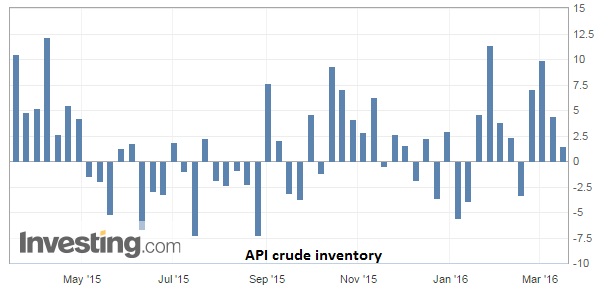

- American Petroleum Institute’s (API) weekly report showed inventory rose by 1.5 million barrels.

Today’s inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Chart courtesy investing.com

Trade idea

- While we are still committed to the downside, our short term call for Crude to reach $41/barrel is still on. Stop loss revised at $34.

- Profit bookings suggested further 20% at jump above $40/barrel.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022