Crude oil (WTI) is up today, however broken a key support around $43/barrel awaiting today's inventory report and FOMC monetary policy announcement. WTI is currently trading at $44.5/barrel.

Key factors at play in Crude market

- Crude oil production is declining for high cost producers, such as shale gas but still not an alarming rate.

- However due to new technologies, crude oil production cost has declined for shale producers.

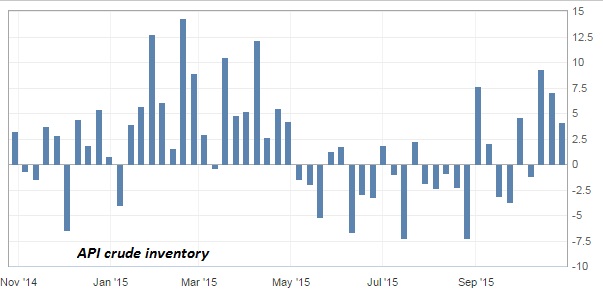

- Crude oil inventory has risen sharply over past few weeks.

- Any cooperation is unlikely with Russia and Saudi Arabia fighting for market share in Europe.

- Almost all investment bank sees price to remain low but rise through next year.

- American Petroleum Institute's (API) weekly report showed inventory surplus by 4.1 million barrels, third consecutive rise in a row.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Trade idea

- WTI soured short term bullish outlook as price kept dropping from $51/barrel to break below $43/barrel.

- Bears now likely to push towards $38/barrel region and towards 2009 low.