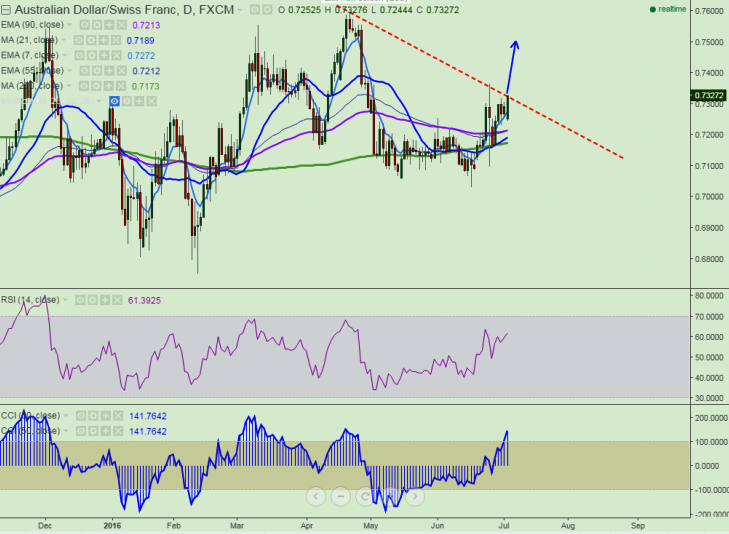

- Major resistance – 0.7325 (trend line joining 0.75894 and 0.7364)

- Major support – 0.7230 (daily Tenkan-Sen)

- AUD/CHF has recovered sharply after making a low of 0.72440 at the time of writing. It is currently trading around 0.7320 .

- Short term trend is still bullish as long as minor support 0.7230 holds.

- On the lower side, minor support is around 0.7230 (daily Tenkan-Sen) and any break below targets 0.7205/0.7160 (200 day MA).

- Short term weakness only below 0.7170 (200 day MA ).

- Technically the minor resistance is around 0.7325 and any break above targets 0.7380/0.7410/0.7450.

It is good to buy above 0.7325 with SL around 0.7250 for the TP of 0.7410/0.7450/0.7500.

R1- 0.7325

R2-0.7380

R3-0.745

Support

S1- 0.7230

S2-0.7170

S3-0.7097