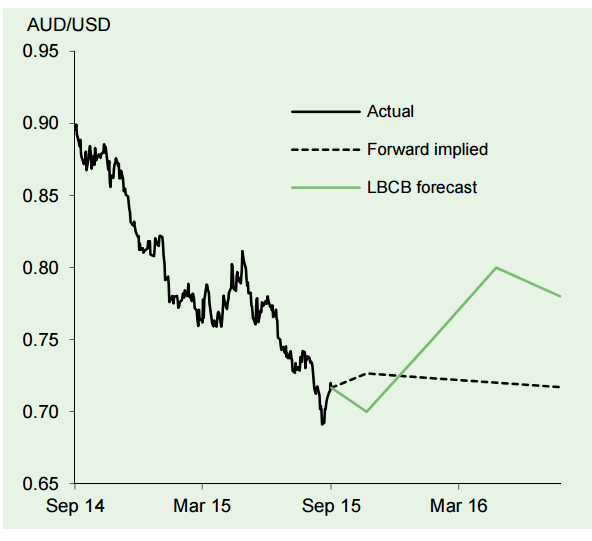

The Australian dollar has extended its depreciating trend over the past month, with AUD/USD briefly falling below 0.70 for the first time April 2009. The main drivers behind this latest leg lower were further declines in commodity prices amid rising concerns about China, both key to prospects for Australian exports.

An improvement in global risk sentiment and a surprisingly 'dovish' line from the US FOMC at its latest policy meeting saw AUD/USD rally above 0.72 but it remains vulnerable to renewed market volatility. More positively, comments from RBA Governor Stevens at his recent semi-annual testimony were more upbeat about economic prospects and also suggested he was comfortable with the current monetary policy setting and level of the exchange rate. Meanwhile, markets still await new Prime Minister Turnbull's policy initiatives.

"We believe further stabilisation in Chinese data and financial markets, aligned with firming commodity prices, should support the AUD. We forecast AUD/USD at 0.75 end 2015, rising to 0.78 at end Q2 2016", notes Lloyds Bank.

AUD/USD Outlook

Wednesday, September 23, 2015 11:23 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX