Advantest Corp. (TYO:6857) shares surged to a record high on Thursday after the Japanese semiconductor testing equipment maker posted strong fiscal third-quarter earnings and raised its full-year guidance, driven by robust artificial intelligence-related demand. The stock jumped more than 14% to an all-time high of 29,250 yen, significantly outperforming the broader market as the Nikkei 225 slipped 0.2% on the day.

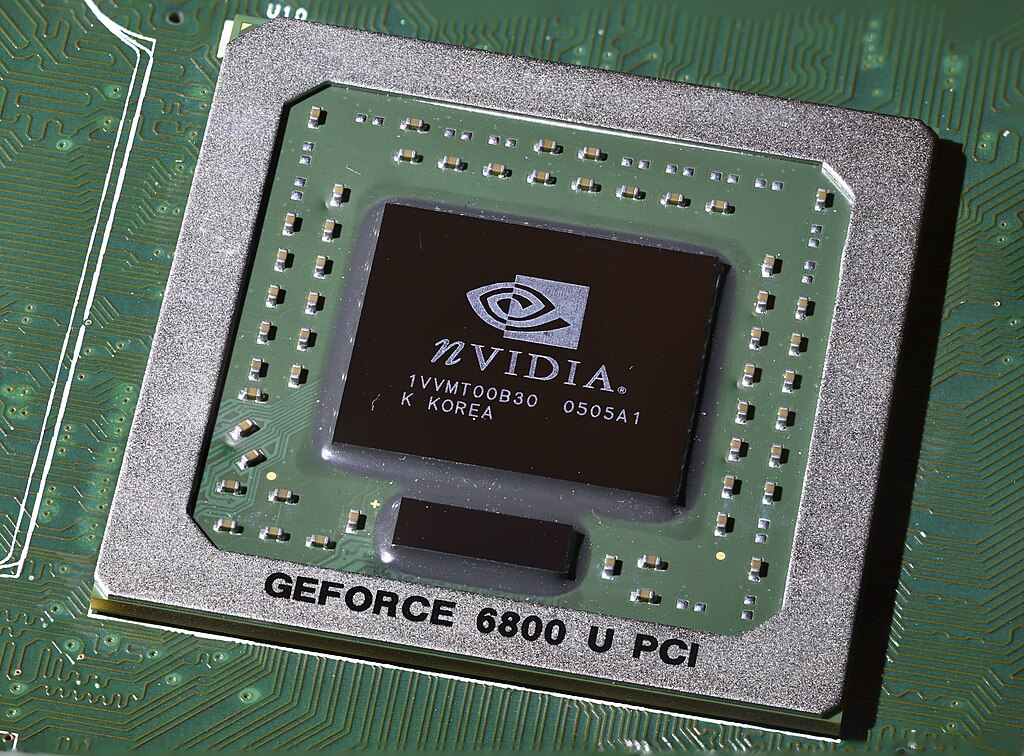

The rally highlights growing investor confidence in companies benefiting from the global AI boom, particularly those closely linked to NVIDIA (NASDAQ:NVDA), one of Advantest’s largest customers. As a key supplier of semiconductor testing equipment to Nvidia, Advantest has been well positioned to capitalize on rising demand for advanced chips used in AI data centers, high-performance computing, and next-generation technologies.

For the three months ended December 31, Advantest reported record-high quarterly profit of 78.7 billion yen (approximately $510 million), reflecting strong order momentum from major chipmakers. Quarterly sales climbed nearly 11% year-on-year to 273.8 billion yen, underscoring sustained demand for its testing solutions amid expanding AI investments across the semiconductor industry.

The company also upgraded its outlook for the fiscal year ending March 31, signaling confidence in continued growth. Advantest now expects full-year sales to reach 1.07 trillion yen, up from its previous forecast of 950 billion yen. Net income is projected to more than double from the prior year to 328.5 billion yen, compared with an earlier estimate of 275 billion yen. The revised guidance further reinforces Advantest’s position as a major beneficiary of the AI-driven semiconductor cycle.

Looking ahead, Advantest said it plans to ramp up its annual production capacity by early 2027, a move that reflects expectations of sustained AI-related demand. Alongside Nvidia, the company has emerged as a standout performer over the past three years as artificial intelligence continues to reshape global chip demand. With strong earnings momentum, upgraded forecasts, and long-term capacity expansion plans, Advantest remains firmly in focus for investors seeking exposure to AI stocks poised to perform in 2026 and beyond.

Foxconn Sees Strong Growth Ahead Despite Limited Impact From U.S.–Israel–Iran Tensions

Foxconn Sees Strong Growth Ahead Despite Limited Impact From U.S.–Israel–Iran Tensions  Iran Crisis Could Threaten AI Data Center Expansion and Global Chip Demand, South Korea Warns

Iran Crisis Could Threaten AI Data Center Expansion and Global Chip Demand, South Korea Warns  Oracle Stock Surges as AI Data Center Boom Drives Revenue Beat and Bullish 2027 Outlook

Oracle Stock Surges as AI Data Center Boom Drives Revenue Beat and Bullish 2027 Outlook  UK Regulators Demand Social Media Platforms Strengthen Children's Age Verification

UK Regulators Demand Social Media Platforms Strengthen Children's Age Verification  Indonesia Issues Stern Warning to Meta Over Online Gambling and Disinformation

Indonesia Issues Stern Warning to Meta Over Online Gambling and Disinformation  Heinz Wattie's to Close Three New Zealand Plants, Cutting 350 Jobs

Heinz Wattie's to Close Three New Zealand Plants, Cutting 350 Jobs  Anduril Industries Acquires ExoAnalytic Solutions to Bolster Space Defense Capabilities

Anduril Industries Acquires ExoAnalytic Solutions to Bolster Space Defense Capabilities  Lockheed Martin Invests $150M in Alabama Missile Production Facility

Lockheed Martin Invests $150M in Alabama Missile Production Facility  Thomas Mazloum Named Chair of Disney Experiences as Leadership Shakeup Takes Effect

Thomas Mazloum Named Chair of Disney Experiences as Leadership Shakeup Takes Effect  Alphabet's GFiber Merges with Astound Broadband to Build Major U.S. Internet Provider

Alphabet's GFiber Merges with Astound Broadband to Build Major U.S. Internet Provider  U.S. Senate Greenlights AI Chatbots for Official Staff Use

U.S. Senate Greenlights AI Chatbots for Official Staff Use  Robinhood Banking Surpasses $1 Billion in Deposits Following Successful Relaunch

Robinhood Banking Surpasses $1 Billion in Deposits Following Successful Relaunch  ANZ and Westpac Forecast Two RBA Rate Hikes in March and May 2026

ANZ and Westpac Forecast Two RBA Rate Hikes in March and May 2026  OpenAI Explores Partnership With The Trade Desk to Expand ChatGPT Advertising

OpenAI Explores Partnership With The Trade Desk to Expand ChatGPT Advertising  Big Tech Turns to Debt Markets to Fund AI Infrastructure Boom

Big Tech Turns to Debt Markets to Fund AI Infrastructure Boom  Honda Faces $4.3 Billion Loss After Scrapping EV Plans

Honda Faces $4.3 Billion Loss After Scrapping EV Plans  Nissan, Uber, and Wayve Team Up to Launch Robotaxi Pilot in Tokyo

Nissan, Uber, and Wayve Team Up to Launch Robotaxi Pilot in Tokyo