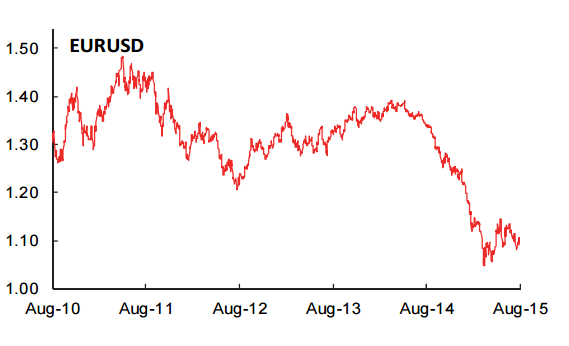

US dollar (USD) gains are expected to intensify into year-end as market participants await the commencement of monetary policy normalization by the US Federal Reserve. Fed policymakers have become increasingly confident in the labor market outlook, with preference to an early and gradual path for monetary tightening; the first benchmark interest rate increase is expected to take place in September. A differentiated foreign exchange performance is expected to take place through 2016, with stabilization and modest strength anticipated for most currencies with the exception of the Japanese yen (JPY) and the euro (EUR).

The Canadian dollar (CAD) is expected to weaken in the near term, its greatest vulnerability arising from the path for oil prices and their implications for monetary policy at the Bank of Canada. CAD is expected to stabilize from its third quarter lows, with a retracement that is largely predicated on the gradual and modest rise in oil prices.

The Mexican peso (MXN) remains on the defensive in connection with the beginning of the US monetary tightening cycle and the potential for capital repatriation flows by foreign (primarily based in the US) holders of Mexican securities. However, the currency should find some support from attractive interest rate differentials and a domestic monetary policy tightening path that is expected to follow that of the US Federal Reserve.

Latin American currencies remain on the defensive, yet some differentiation dynamics are evident. At the very negative end of the spectrum, both the Brazilian real (BRL) and the Colombian peso (COP) have experienced the sharpest depreciation versus the USD. The BRL has been severely hit by the combined negative impact of sustained recession, high inflation (in the high single digits), widening fiscal and current account deficits, and poor market sentiment affecting emerging-market assets.

Moreover, Brazil remains vulnerable to multiple downward revisions to its sovereign credit ratings. The COP has been associated with the oil price shock and the ensuing economic impact from sizable CAPEX reductions in the energy sector, with the Peruvian (PEN) and Chilean (CLP) currencies receiving adverse headwinds from still-correcting commodity prices.

Americas foreign exchange outlook

Thursday, July 30, 2015 8:52 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022