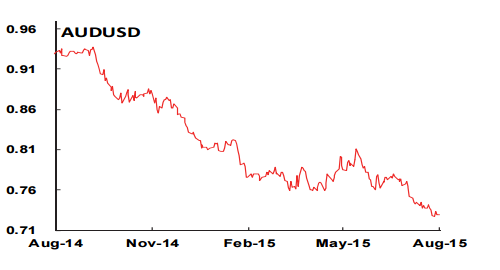

The Australian dollar (AUD) decline is anticipated to continue into year-end, before stabilizing through 2016 on the back of a shift in its balance of risks. While any further benchmark interest rate cuts are not expected by the Reserve Bank of Australia, the country's monetary authorities continue to stress their preference for currency weakness.

"JPY weakness is expected to take place through the end of our forecast profile, as we look to the maintenance of an aggressively accommodative monetary policy stance by the Bank of Japan," says scotiabank.

Developing Asian currencies are facing a strong depreciation bias, reflecting shifts in investor risk appetite for emerging market assets ahead of the approaching monetary policy normalization in the US. Moreover, volatility in the Chinese equity market is adversely affecting sentiment across the region. China's monetary authorities are keeping the Chinese yuan (CNY) stable ahead of the forthcoming exchange rate reform that is expected to widen the currency's trading band to ±3% (from ±2%) around the People's Bank of China's central parity for USDCNY. This would give market forces a substantially more influential role in determining the currency's valuation; the CNY will function as an important shock absorber when Chinese authorities move ahead with their interest rate and capital account liberalization agenda.

The South Korean won (KRW) has been one of the weakest currency performers in the region over the past month; its depreciation against the JPY will be a welcome development for South Korean exporters who have felt the adverse impact from the substantial yen weakness evidenced over the past few years. In Thailand, further decline in the value of the Thai baht (THB) will likely play a larger role as economic growth supporter than additional monetary policy accommodation.

Asia-Pacific: Foreign exchange outlook

Thursday, July 30, 2015 9:25 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX