In Brazil a hike in the Selic rate to 14.25% is widely expected.

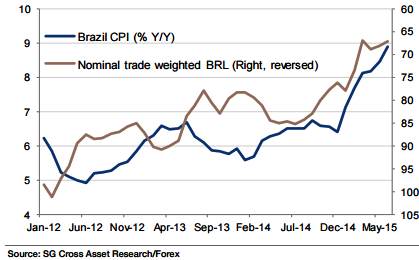

The BRL has been hit by a combination of poor growth, political graft, weak balance of payments and falling commodity prices, and the currency's fall has been one factor behind faster inflation. Hence the rate hike amidst weak growth.

"If the FX market reacts by selling the currency with increased fervour, which is expected, there's a risk the real's woes fuel the sense that an eventual Fed move can cause extended risk aversion", says Societe Generale.

Which is a risk exacerbated, of course, by the fall in oil prices.

BCB to hike Selic rate to 14.25

Wednesday, July 29, 2015 7:20 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022