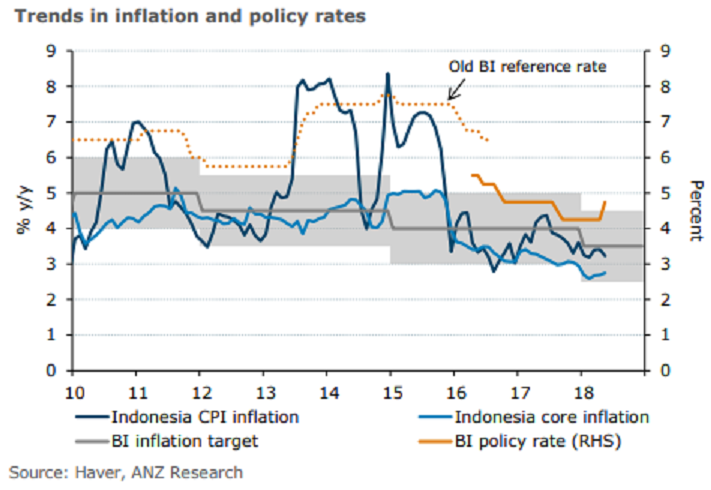

Bank Indonesia (BI) is expected to call for a final rate hike of 25 basis points in its June monetary policy meeting, according to the latest report from ANZ Research. Headline inflation has remained below the mid-point of the central bank’s target band in each month this year, confirming that the objective of the recent policy tightening is to stabilize the IDR and not inflation management.

Owing to the commencement of the Ramadan fasting season from mid-May, headline inflation quite predictably picked up during the month. The increase itself was more contained m/m than was expected owing to moderate increases in food prices (0.21 percent m/m) and energy costs (0.04 percent m/m).

The rise in energy prices compares with an average of 0.29 percent m/m in the previous four months of 2018. Similarly, utility costs, which include electricity costs, also increased by their slowest pace during the year.

Price changes in other sub-components were in line with recent trends. Core inflation increased by 0.21 percent m/m which though faster than the 0.15 percent m/m rise in April, was still mild. Headline inflation has now remained below the mid-point of Bank Indonesia’s (BI) target corridor of 2.5-4.5 percent in each month this year, confirming that the objective of the recent policy tightening is to stabilize the IDR and not inflation management.

"To further this objective we still expect one more rate hike of 25bps in June 2018, following which BI should be able to comfortably revert back to a neutral policy stance," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan