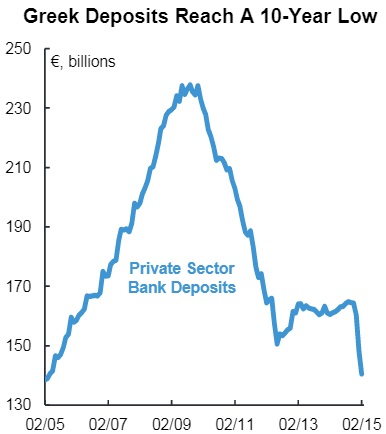

Greek government may have the vote of confidence among Greek people but not their share of wallet. Latest data suggests that bank run still remains at large in Greece. Data reveal deposits were withdrawn at dramatic pace from Greek banks prior to the bailout extension.

- Austerity filled bailout package stabilized Greece's deposits, however it remains far lower than pre-crisis level.

- Chart, obtained from Scotiabank via sober look shows, Greek deposits in private banks rose close to € 250 billion before crisis has not been close to the level since.

- In 2011/12 at the peak of the crisis, deposits dropped by 40% to just around € 150 billion. Years of austerity and OMT by ECB has not been able to improve such so far

- Before deteriorating, Greek 10 year yield fell close to 6%, however total deposits held in private sector remained below € 170 billion.

- While new Syriza led government remained at loggerheads in February, deposits fell sharply close € 130 billion, almost at 10 year low.

Current highlights -

- So far, Greece has not reached an agreement with creditors in Eurozone. However, possibilities of a deal has risen over next month.

- ECB is not buying Greek government bonds as of now, in its current asset purchase program. ECB has also asked the Greek banks not to increase their holdings of govt. treasury bills, thus limiting market access. ECB has also withdrawn its waiver on Greek bonds and rationing the ELA in smaller portions.

Euro might get a boost from an imminent deal, however the crisis will not be over until these underlying currents take turn for good. Fragile Greek banks remain a concern.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary