Bitcoin’s price tumbled under $69,000 on Nov. 3, sparking nearly $350 million in liquidations as Trump’s election odds faced new challenges. With market uncertainty climbing, crypto traders are bracing for further swings tied to the election’s outcome.

Bitcoin Dips Below $69K, Triggers Massive Liquidations Ahead of Election

Traders appeared anxious in the days leading up to the US presidential election, as Bitcoin momentarily fell below $69,000 and crypto market liquidations nearly reached $350 million.

According to CoinGlass, a total of $349.78 million was liquidated on November 3rd, including $259.7 million in long bets and $90.08 million in short bets. This is the biggest trading day for Bitcoin since October 25th, when the price fell short of $70,000 and couldn't recover.

Bitcoin’s Wild Price Swings Amid Election Tensions

In the past week, the price of Bitcoin has fluctuated wildly, beginning on October 28 at roughly $67,700 and going all the way up to over $73,300 on October 29. Then, after a minor fall to $67,719 on November 3, the price dropped steadily over the following days, Cointelegraph points out.

According to CoinGecko, it has swiftly recovered and is currently trading at $69,145.

Trump’s Odds and Bitcoin’s Unstable Performance

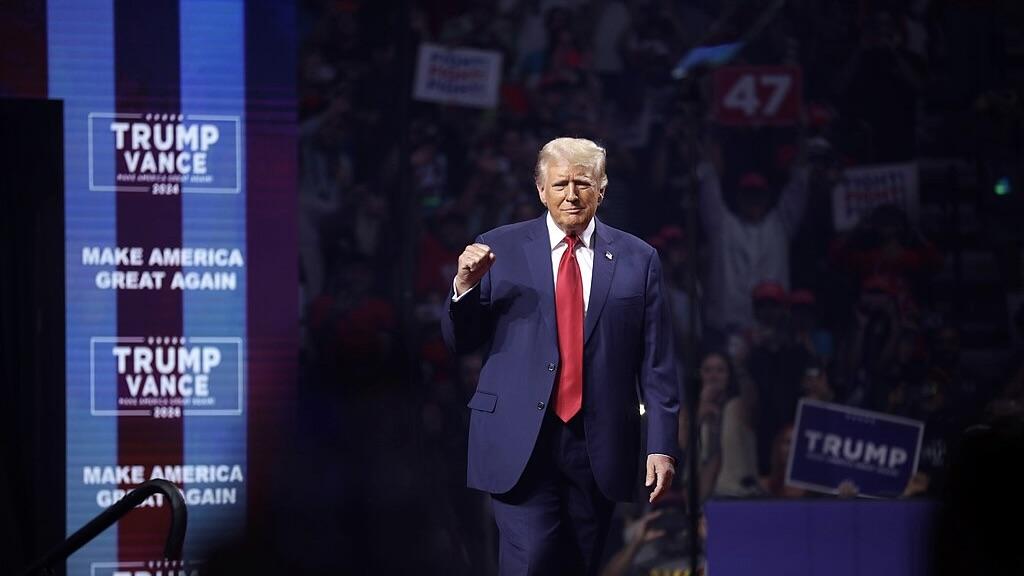

With the odds gap between US presidential bidders Donald Trump and Kamala Harris narrowing on the crypto-native betting site Polymarket, the price activity of Bitcoin has been somewhat unpredictable.

With Trump's odds of winning the Nov. 5 elections having peaked at 67% on Oct. 30, they have since experienced a steep decline to 56%, marking the beginning of October as the most probable winner, surpassing Harris on Polymarket.

Crypto Industry’s Preference and Policy Differences

Since Trump has pledged to do things like dismiss SEC Chair Gary Gensler and make the US "the world capital of crypto," the crypto business sees him as the more accommodating presidential candidate.

In her campaign speech to Black male voters, Democratic Party candidate Harris has taken a more moderate stance on cryptocurrency, stating that she would back a regulatory framework for the industry.

Implications for Bitcoin’s Price with Election Outcome

Polls suggest that Trump and Harris are virtually even for the lead, with Trump's winning odds on Polymarket now more in line with these results. Harris held a 0.9 percentage point advantage on November 3, according to data from FiveThirtyEight.

While some in the trading community have predicted that Bitcoin's price could reach $100,000 if Trump were to win the election, Bernstein analysts have predicted that a Harris victory would cause Bitcoin's price to fall substantially by year's end.

"Bitcoin could see at least a 10% move to either direction depending on who ends up winning the election," said crypto trader Daan Crypto Trades in response to the election results.

Philippines, U.S., and Japan Conduct Joint Naval Drills in South China Sea to Boost Maritime Security

Philippines, U.S., and Japan Conduct Joint Naval Drills in South China Sea to Boost Maritime Security  Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran

Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran  OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War  ETHUSD Blasts Past $2000 Milestone — Following Bitcoin’s Lead, Bulls Charge Toward $2380–$2500

ETHUSD Blasts Past $2000 Milestone — Following Bitcoin’s Lead, Bulls Charge Toward $2380–$2500  Snowflake Forecasts Strong Fiscal 2027 Revenue Growth as Enterprise AI Demand Surges

Snowflake Forecasts Strong Fiscal 2027 Revenue Growth as Enterprise AI Demand Surges  FedEx Faces Class Action Lawsuit Over Tariff Refunds After Supreme Court Ruling

FedEx Faces Class Action Lawsuit Over Tariff Refunds After Supreme Court Ruling  Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates  Trump to Address Nation as U.S. Launches Strikes in Iran, Axios Reports

Trump to Address Nation as U.S. Launches Strikes in Iran, Axios Reports  BTC Hovers Flat Near $68K Ahead of US-Iran Talks — Bulls Eye Break Above $70,050 for $78K Rocket

BTC Hovers Flat Near $68K Ahead of US-Iran Talks — Bulls Eye Break Above $70,050 for $78K Rocket  U.S.-Iran Nuclear Talks Show Progress but No Breakthrough Amid Rising Military Tensions

U.S.-Iran Nuclear Talks Show Progress but No Breakthrough Amid Rising Military Tensions  ETHUSD Weakens Further: $1,825 CMP, All EMAs Red, Sell Rallies @ $1,948–50

ETHUSD Weakens Further: $1,825 CMP, All EMAs Red, Sell Rallies @ $1,948–50  APEX Tech Acquisition Inc. Raises $111.97 Million in NYSE IPO Under Ticker TRADU

APEX Tech Acquisition Inc. Raises $111.97 Million in NYSE IPO Under Ticker TRADU  Trump Pushes Tech Giants to Build Power Plants to Offset AI Data Center Energy Costs

Trump Pushes Tech Giants to Build Power Plants to Offset AI Data Center Energy Costs  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K