The Brazilian government is trying to build a more positive economic agenda by announcing infrastructure concession projects, aimed at increasing investments and addressing growth bottlenecks.

However, there are uncertainties regarding their timing and scope, and any long-term positive agenda, tackling the high costs of doing business in Brazil, will likely have no space in it for these, given the difficulty in guaranteeing a majority in a fairly fragmented Congress to push long-due reforms forward.

Earlier today, the Brazilian government announced new concessions aimed at increasing infrastructure investments in four transportation areas: toll roads, railroads, ports and airports. The government expects these projects to sum to BRL198.4bn (c.3.3% of GDP), with BRL69.2bn of this invested between 2015 and 2018 and the remaining BRL129.2bn invested from 2019 onwards.

The BNDES will play a major role in financing these projects, especially on railroads, but at the same time, the government is encouraging issuance of debentures to foster capital markets.

The announcement was already broadly expected and is a clear attempt by the economics team to build a more positive, pro-growth agenda, after a first semester marked by fairly negative headlines due to the fiscal adjustments and the consequent cuts in labor and social expenditures, as well as the increase in some tax rates.

Indeed, the new economic team continues to push for a closer relationship between the government and the private sector, which is without a doubt crucial for investments to resume in Brazil.

However, when taking a look at the broad numbers, almost 20% of the total concession package comes from one project (Trans-Pacific): building a railroad from Brazil to the Pacific Ocean, viability studies for which will be ready only by May 2016; therefore, uncertainties regarding the pipeline of such investments remain high.

Certainly, infrastructure bottlenecks are one of several issues that have increased the costs of doing business in Brazil, and in that sense, conceding these investments to the private sector is a positive step.

Barclays notes:

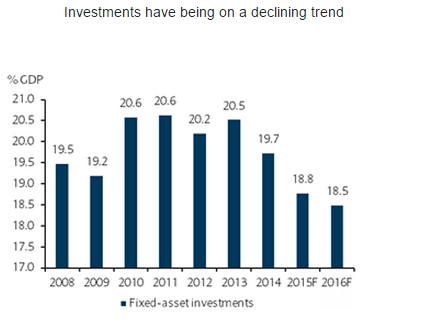

- The government already had a concession program in 2012 that did not have a meaningful effect on investments: as a share of GDP, investments decreased to 19.6% in Q1 15 from 20.6% in Q4 11, and we forecast even further declines.

- More importantly, we believe a pro-growth agenda that would increase the competitiveness of the country must tackle long-due macroeconomic reforms, especially the fairly complicated and abstruse tax system, the growing deficit of the pension system (and thereafter engaging in more efficient fiscal expenditures), and increasing the empowerment of regulatory agencies.

- We are fairly skeptical that the government will be able to push any agenda for these topics forward. As we wrote in Inside Brazil: Elections results: Rousseff wins another term, 27 October 2014, the fragmented Congress creates a significant challenge in building a consensus or majority in both houses (Lower House and the Senate) to push forward any of these reforms.

- The tense relationship between the executive and legislative powers during this first semester over tweaks to the fiscal policy stance supports our view.As a result, we believe that it will be hard for the government to push a real positive agenda forward.

- We forecast that the primary fiscal result should be about 0.8% of GDP this year and 1.5% in 2016, which not only falls short of the government's target but also implies that further fiscal austerity measures will have to be put in place in the foreseeable future.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022