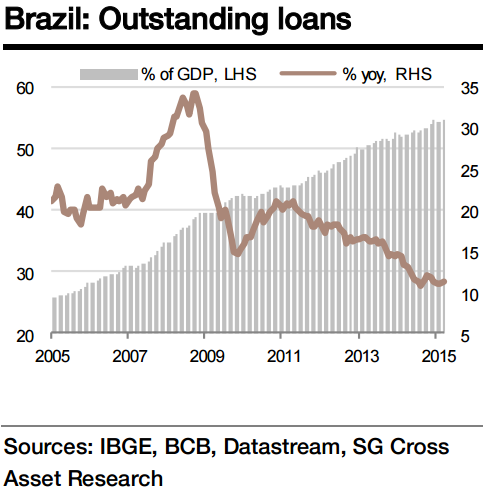

After a brief pick-up in H2 14 on liquidity measures, Brazil's credit growth resumed its decelerating trend. In fact, credit growth has been on a decelerating trend since the end of 2010 and it would be difficult to expect any turnaround in it given the shape of the economy, investor sentiment, and the ongoing monetary and (now) fiscal tightening.

According to Societe Generale, "Credit growth is expected to fall from 10.1% yoy in May to 9.6% in June as the business credit growth likely slipped to 8.9% yoy and the credit growth to individuals slowed to 10.5%. The current pace of credit growth is significantly weaker than the pace of 18.6% seen during 2010-12 or even the average pace of 14.1% during 2013-14. Although credit growth is slightly stronger in the consumer segment, that too has witnessed a continued slowdown and is one of the key reasons behind the slowdown in consumption growth recently."

Slowdown in credit growth has stabilised the credit-to-GDP ratio to a little above 54% of GDP after continued acceleration throughout the past decade and until 2014, adds SocGen.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed