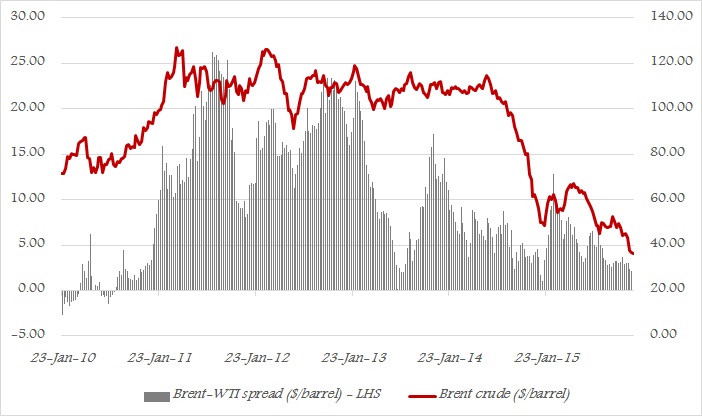

In last night's trading, global benchmark for crude oil Brent of North Sea has fallen to discount to its North American counterpart West Texas Intermediate (WTI) first time since November last year, before that it happened back in 2010.

Back in 2011/12 Brent traded more than $25/barrel premium to WTI, due to North American supply glut, as US crude was trapped in the country due to export ban. Even in 2014, Brent traded as high as $17.3/barrel premium to WTI.

The premium has shrank since mid-2014, as supply glut which was thought to have concentrated in US, affected global supply and leading to war among largest producers.

Now crude oil is plenty in both US and abroad.

Last week, US lawmakers voted in favor of lifting 40 year old ban (imposed during oil embargo era) on US crude export. That didn't help WTI much on the upside, but pushed the spread marginally in favor of WTI.

Future of this spread will depend on how fast US producers can form strategic partnerships for oil production around the world, especially in Europe. Many in European countries are eager to diversify to US crude to end Russia's monopoly in the region.

WTI is currently trading at $36.4/barrel, at zero spread to Brent.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed