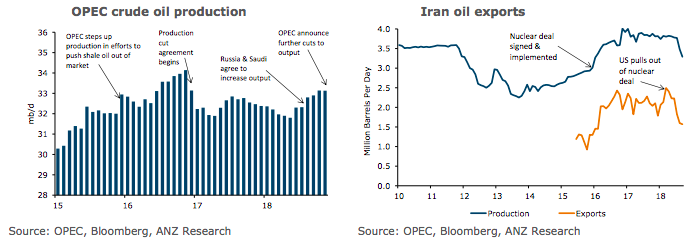

Brent crude oil is expected to reach USD75/bbl by the first quarter of 2019, while the year-end target stands at USD65/bbl; further, the United States shale oil output is seen to keep rising over the next 18 months, according to the latest research report from ANZ Research.

The agreement of a reduction in output of 1.2mb/d at last week’s OPEC meeting was much more than what we and the market had expected. The cuts will be based on production levels in October 2018 and are only expected to last for six months.

It will be split in the form of 800kb/d from OPEC members and 400kb/d from non-OPEC members. The agreement did not list any specific country targets. However Iran, Libya and Venezuela have been exempt from the agreement.

It is also expected that Saudi Arabia will make up most of the OPEC cuts, with Energy Minister Khalid Al-Falih saying production would be 10.2mb/d in January, down from 11.1mb/d in November. Overall, this should keep the market relatively balanced in 2019.

"Overall we have the market remaining in deficit in H1 2019, before weaker economic growth and the production cut agreement roll off, resulting in a balanced market. The risks of further supply disruptions, while relatively diminished remain elevated," the report commented.

Dollar Steady as Fed Nomination and Japanese Election Shape Currency Markets

Dollar Steady as Fed Nomination and Japanese Election Shape Currency Markets  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  Gold Prices Rebound Near Key Levels as U.S.-Iran Tensions Boost Safe-Haven Demand

Gold Prices Rebound Near Key Levels as U.S.-Iran Tensions Boost Safe-Haven Demand  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth  China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order

China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order  South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target

South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX