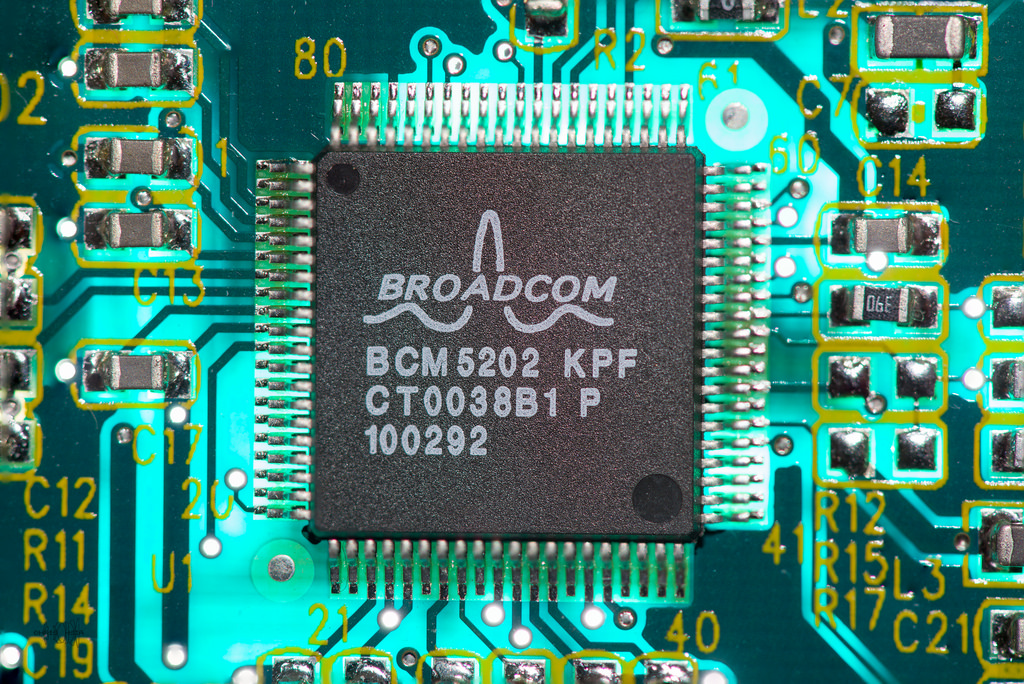

At face value, $121 billion might seem like a lot of money, but this doesn’t seem to be the case with everyone. Specifically, this amount of money didn’t faze investors of the giant chip maker Qualcomm when it was offered by another chip making company, Broadcom. The latter has been trying to buy the former since last year, with the latest offer being quite a bit bigger than the previous $105 billion placed on the table.

Broadcom made its new offer on Monday, The Wall Street Journal reports, placing the amount at $82 a share. The money would be paid partially in cash and the rest in stock, with the ratio kept relatively the same as last time. This could potentially be the single biggest technology deal in history, but it seems that it’s just not enough to convince the investors.

This is a bit confusing to the owner and CEO of Broadcom, Hock Tan, who can’t seem to understand why the deal isn’t being finalized right now. $121 billion is a huge amount of money and investors are supposed to like money.

“Any rational board would consider what we’ve put forward,” Tan told The New York Times over the phone.

With regards to what this deal could potentially mean, an acquisition would create one of the biggest monopolies in the tech industry. Qualcomm currently provides the components to a majority of smartphones and mobile devices being manufactured and this is despite its current legal spat with Apple.

If Broadcom does end up acquiring its target, it could mean that no other competitor could come close to touching the company in terms of the territory it could cover. Of course, there are no guarantees since trouble could be brewing for Qualcomm right now.

According to recent predictions by analysts, Apple could start relying only on Intel for its chips moving forward. This which would put Qualcomm in a tight spot.

Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised