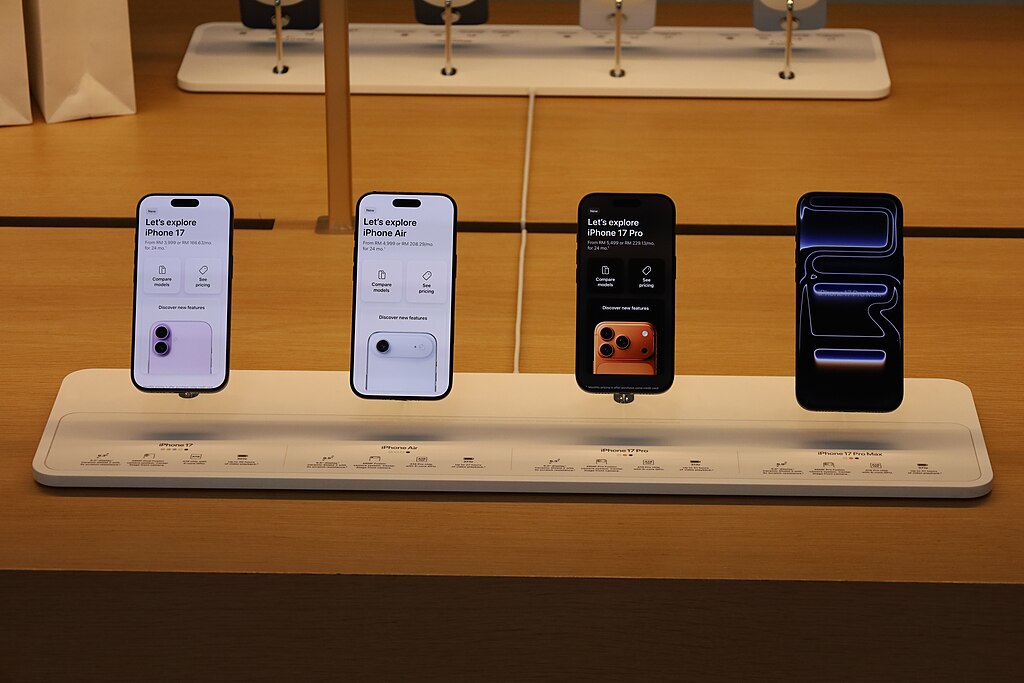

Apple (NASDAQ: AAPL) emerged as the clear winner in China’s Singles’ Day smartphone market, driving a rare 3% year-on-year increase in overall sales despite a challenging environment for most domestic manufacturers. According to new data from Counterpoint Research, robust demand for the iPhone 17 series fueled Apple’s strong performance, putting the company ahead of local rivals still facing cautious consumer spending.

Counterpoint reported that the standard iPhone 17 model generated the highest momentum, boosted by expanded storage options, upgraded camera capabilities, and advanced sensors—while maintaining last year’s pricing. These enhancements helped Apple outperform expectations, particularly in a market where shoppers have grown more selective. Strategic promotions, including discounts of about 300 yuan on the Pro lineup, further accelerated sales. Analysts noted that shipments of the base iPhone 17 more than doubled, while the Pro and Pro Max models registered strong mid- to high-double-digit growth.

However, excluding Apple, Singles’ Day smartphone sales dropped 5% from a year earlier, underscoring subdued consumer sentiment as the fourth quarter begins. Counterpoint highlighted that many customers had already upgraded earlier in the year through subsidy programs, reducing the pool of potential Singles’ Day buyers. Meanwhile, major smartphone brands shifted their focus to newly launched premium devices, raising average selling prices but putting downward pressure on unit volumes.

Among domestic brands, Huawei recorded the sharpest decline as its flagship Mate 80 series missed the crucial sales window by two weeks. Xiaomi (HK: 1810) also saw an 11% year-on-year drop in sales, with its Xiaomi 17 series hitting the market too early to capitalize on November’s peak shopping period.

Apple’s dominance this Singles’ Day underscores its continued strength in China’s premium smartphone segment and highlights how strategic pricing, timely product launches, and meaningful upgrades can shift market momentum even in a cautious economic climate.

United Airlines Boeing 787-9 Makes Emergency Landing in Los Angeles After Possible Engine Fire

United Airlines Boeing 787-9 Makes Emergency Landing in Los Angeles After Possible Engine Fire  OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO

OpenAI Secures $110 Billion Funding Round at $840 Billion Valuation Ahead of IPO  OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute

OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War  Blackstone Expands BCRED Investor Payouts Amid Rising Private Credit Market Concerns

Blackstone Expands BCRED Investor Payouts Amid Rising Private Credit Market Concerns  Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal

Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal  AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready  AWS Data Centers in UAE and Bahrain Hit by Drone Strikes Amid Middle East Conflict

AWS Data Centers in UAE and Bahrain Hit by Drone Strikes Amid Middle East Conflict  OpenAI and U.S. Defense Department Update Agreement to Clarify AI Usage Terms

OpenAI and U.S. Defense Department Update Agreement to Clarify AI Usage Terms  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Anthropic Resists Pentagon Pressure Over Military AI Restrictions

Anthropic Resists Pentagon Pressure Over Military AI Restrictions  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Hyundai Motor Plans Multibillion-Dollar Investment in Robotics, AI and Hydrogen in South Korea

Hyundai Motor Plans Multibillion-Dollar Investment in Robotics, AI and Hydrogen in South Korea  Qantas CEO Warns of Aviation Impact as Oil Prices Surge Amid U.S.-Israel-Iran Conflict

Qantas CEO Warns of Aviation Impact as Oil Prices Surge Amid U.S.-Israel-Iran Conflict  Lynas Rare Earths Shares Surge 7% After Malaysia Renews Processing Plant Licence for 10 Years

Lynas Rare Earths Shares Surge 7% After Malaysia Renews Processing Plant Licence for 10 Years