Even though positive economic data are necessary for a sustainable EUR recovery, but they are not likely sufficient.

The ECB has committed itself to 19 months of asset purchases and will keep going "until we see a sustained adjustment in the path of inflation."

RBC Capital Markets notes as follows on Friday...

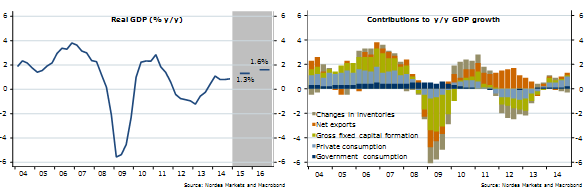

Better economic data will help close the output gap and eventually lead to inflationary pressures, but with the output gap still large (and highly uncertain), it will take a long time for this to feed through to inflationary pressures.

Can EUR rally on economic data alone?

Friday, March 13, 2015 7:10 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed