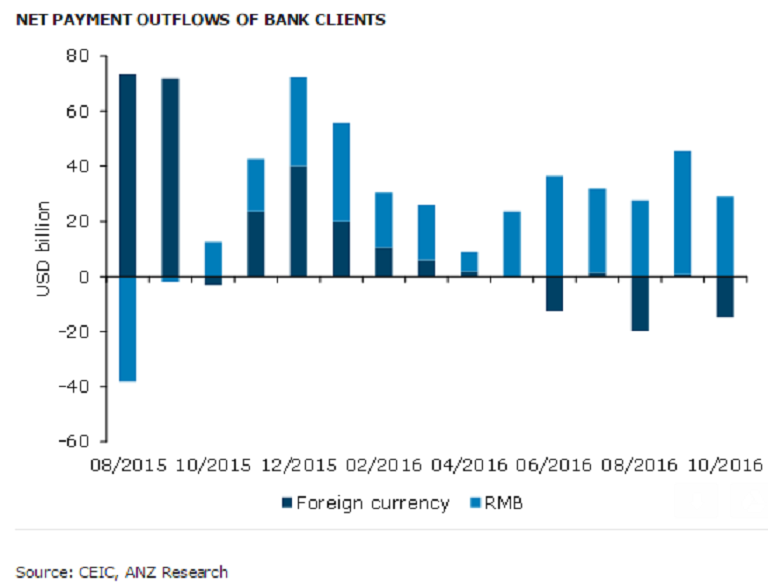

Capital outflows from China have increased over the past few months, averaging to SD24 billion a month since May. But the net payments are dominated in RMB instead of in the USD. In fact, banks report net receipts in foreign currency (mostly in USD). This is consistent with the decline in foreign exchange buying by banks' clients (October: -20 percent y/y) in the onshore market.

Chinese regulators will tighten the capital flows in yuan and foreign exchange operations of local financial institutions. As onshore buying of foreign currency becomes increasingly difficult, Chinese residents will be encouraged to send funds in the local currency for conversion abroad. Thus the offshore market will face stronger yuan depreciation pressure. This may trigger some regulatory actions to tighten the RMB outflows, ANZ reported.

The policy stance of China's central bank seems to have shifted from directly managing the exchange rate to preserving foreign reserves. On one hand, the central bank has adopted the policy to adjust RMB exchange rate with reference to a basket of currencies.

The People's Bank of China (PBoC) seems to have a higher tolerance for exchange rate flexibility and allow the yuan to weaken in light of USD strengthening. On the other hand, the State Council is reportedly tightening overseas investment activities and acquisitions of Chinese enterprises. The authorities seem to be targeting the quantity of cross border flows.

"In our view, China should strengthen the use of interest rate instruments to influence the yuan exchange rate indirectly if the country continues to commit to capital account liberalization," the report said.

Meanwhile, the USD/CNY currency pair has formed a bearish engulfing pattern at 6.88, down 0.22 percent and having support at 6.85-6.87, while resistance is maintained at 6.89-6.91.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination